Progressive Snapshot discount eligibility? Yeah, that’s a pretty big deal if you’re trying to save some serious cash on your car insurance. Basically, Progressive uses a device in your car to track your driving habits – think speed, braking, mileage, even how often you drive at night. They use this data to calculate a personalized discount, rewarding safe drivers with lower premiums.

It’s like a video game for your insurance, except the prize is cheaper car insurance. This guide will break down everything you need to know about getting and keeping that sweet, sweet discount.

We’ll cover everything from signing up and installing the device to understanding how your driving impacts your score and ultimately, your discount. We’ll even compare Progressive Snapshot to other similar programs so you can see how it stacks up. Get ready to become a data-driven driving champion and save some serious dough!

Defining “Progressive Snapshot Discount Eligibility”

Progressive Snapshot is a usage-based insurance program that uses a small device plugged into your car’s diagnostic port to track your driving habits. Based on this data, Progressive assesses your driving and assigns a discount. It’s designed to reward safe drivers with lower premiums, essentially making your insurance cost reflect your actual driving behavior.Progressive Snapshot analyzes several key aspects of your driving to determine your discount.

The core components of the program involve collecting data on your driving habits, analyzing that data through a proprietary algorithm, and then applying a discount based on the results. This means that unlike traditional insurance, where your rate is largely determined by factors like age, location, and car type, Snapshot also takes your individual driving performance into account.

Discount Tiers Available

The discount you receive isn’t a single fixed amount. Progressive offers a range of discounts, typically expressed as a percentage off your base rate. The specific discount tier you qualify for depends entirely on your driving score, which is calculated from your driving data. While the exact tiers and percentages aren’t publicly listed and can vary by state and individual circumstances, you can generally expect a discount if your driving is deemed safe.

For example, some drivers might receive a 5% discount, while others with exemplary driving records might receive a 30% or even higher discount. The higher your score, the larger the potential discount.

Factors Influencing Eligibility

Several factors influence your eligibility for a Progressive Snapshot discount. The primary factor is your driving score, which is determined by analyzing your driving data collected by the Snapshot device. This data includes metrics such as your mileage, driving time of day, acceleration, braking, and cornering habits. Other factors, although less direct, can indirectly influence the outcome.

For example, a driver who frequently drives in high-traffic areas might have a slightly lower score due to more frequent braking and acceleration, even if their overall driving style is safe. The length of time you participate in the program also matters; a longer participation period usually allows for a more accurate assessment of your driving behavior.

Examples of Positive and Negative Driver Behaviors

Positive driving behaviors that contribute to a higher Snapshot score and a larger discount include maintaining consistent speeds, avoiding harsh braking and acceleration, and driving during off-peak hours. Smooth driving is key; think gentle acceleration and braking, avoiding sudden maneuvers. Conversely, negative driving behaviors that could lower your score and reduce your discount include frequent hard braking, excessive speeding, nighttime driving, and frequent short trips.

For example, constantly slamming on the brakes in stop-and-go traffic will negatively impact your score, as will frequent high-speed driving, especially at night. Aggressive driving in any form will almost certainly lead to a lower discount.

Enrollment Process and Requirements

Signing up for Progressive Snapshot is pretty straightforward, but there are a few things you need to know before you dive in. This program uses a small device plugged into your car’s OBD-II port to track your driving habits, and based on that data, you might get a discount on your car insurance. Let’s break down the process and requirements.

Enrollment Steps

To enroll, you’ll first need to be an existing Progressive customer or initiate a new policy application. Then, you’ll need to sign up for Snapshot through your online Progressive account or by contacting a Progressive representative. Once you’ve signed up, Progressive will mail you a Snapshot device. After receiving the device, you’ll plug it into your car’s OBD-II port (usually located under the dashboard), and you’re ready to start tracking your driving.

Device Installation and Usage Requirements

The Snapshot device is designed for easy installation. Simply locate your car’s OBD-II port, plug in the device, and make sure it’s securely connected. The device needs to remain plugged in for the duration of the program, typically 30 days. During this time, you should drive as you normally would, avoiding any deliberate attempts to manipulate the data.

Progressive monitors various driving metrics, so driving safely and consistently is key. If you disconnect the device prematurely or encounter any issues, contact Progressive customer service.

Data Collection Methods

Progressive’s Snapshot program collects data through the device plugged into your car’s OBD-II port. This data includes metrics such as mileage driven, time of day you drive, acceleration and braking patterns, and the number of hard brakes or sudden accelerations. The system doesn’t track your location or specific destinations; it focuses solely on your driving behaviors. This data is analyzed to assess your driving habits and determine your eligibility for a discount.

Enrollment Process Flowchart

| Step | Action | Outcome | Next Step |

|---|---|---|---|

| 1 | Sign up for Progressive Snapshot through your online account or by contacting Progressive. | Snapshot enrollment confirmation. | 2 |

| 2 | Receive Snapshot device in the mail. | Device received. | 3 |

| 3 | Plug the device into your car’s OBD-II port. | Device connected and data collection begins. | 4 |

| 4 | Drive normally for the designated period (typically 30 days). | Driving data collected. | 5 |

| 5 | Progressive analyzes driving data. | Discount eligibility determined. | 6 |

| 6 | Receive notification regarding discount eligibility and potential rate adjustment. | Policy update (if applicable). | End |

Data Analysis and Scoring

Progressive Snapshot uses a sophisticated algorithm to analyze your driving data and determine your eligibility for a discount. The system isn’t just about tallying speeding tickets; it looks at a range of driving behaviors to create a comprehensive picture of your driving habits. This holistic approach allows for a more nuanced and fair assessment of risk.The scoring system weighs various factors to calculate your overall driving score.

This score directly impacts the size of your discount, with better scores leading to greater savings. The algorithm isn’t a black box; it’s designed to reward safe and responsible driving.

Driving Behavior Metrics

The Snapshot program analyzes several key aspects of your driving. These metrics are weighted differently to reflect their relative impact on safety and accident risk. For example, hard braking is considered more serious than minor speeding infractions because it often indicates a more immediate and potentially hazardous situation.

Scoring System Details

The scoring system isn’t simply a point system where you lose points for each infraction. Instead, it uses a proprietary algorithm that considers the frequency, severity, and context of each driving event. A single instance of hard braking in an emergency situation might not carry the same weight as frequent hard braking in normal driving conditions. Similarly, exceeding the speed limit by a few miles per hour in a low-traffic area will likely be weighted differently than consistently speeding by 15 mph in heavy traffic.

Scoring Factor Breakdown

| Driving Behavior | Description | Weighting (Illustrative) | Impact on Discount |

|---|---|---|---|

| Hard Braking | Sudden and forceful braking events. | High | Significantly impacts score; frequent hard braking reduces discount. |

| Speeding | Driving above the posted speed limit. | Medium | Moderately impacts score; consistent speeding reduces discount. |

| Night Driving | Driving during nighttime hours. | Low | Slightly impacts score; more night driving may slightly reduce discount. |

| Mileage | Total distance driven during the monitoring period. | Low | Generally, higher mileage slightly reduces discount due to increased exposure to risk. |

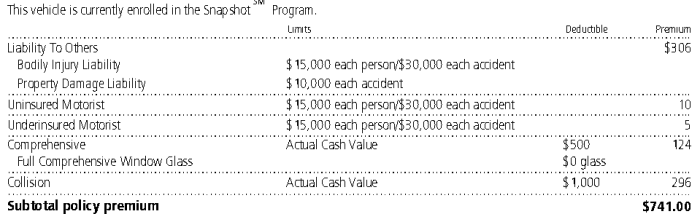

Discount Application and Renewal

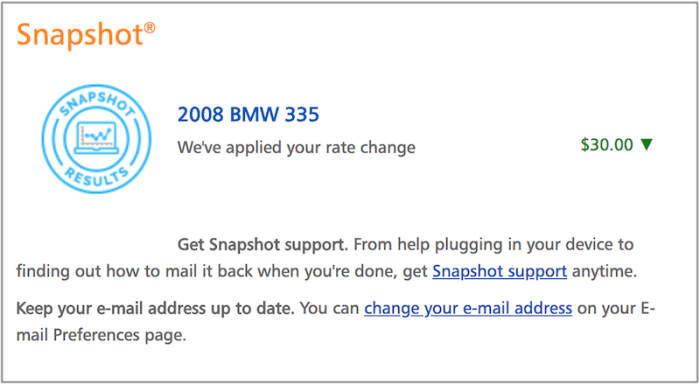

Progressive Snapshot discounts are applied directly to your overall insurance premium. The bigger your discount, the lower your final bill! Your driving score determines the size of your discount, and it’s recalculated every six months. This means you could see your savings fluctuate based on your driving habits.The discount amount varies depending on your individual driving score.

A higher score reflects safer driving habits and results in a larger discount. For example, a driver with a consistently high score might receive a 30% discount, while a driver with a lower score might receive a smaller discount, perhaps 10%, or even no discount at all if their driving habits are consistently unsafe. Progressive uses a proprietary algorithm to analyze your data and assign your score; this algorithm considers many factors including speed, acceleration, braking, and mileage.

Discount Calculation and Application

Your Progressive Snapshot discount is calculated based on your six-month driving score. This score is then translated into a percentage discount, which is directly subtracted from your base premium. The resulting amount is your final premium for the next six-month period. This process is automated, so you don’t have to do anything once you’ve enrolled. Your discount will automatically adjust with each six-month scoring period.

Discount Renewal and Eligibility Maintenance

To maintain your discount, you need to keep your Progressive Snapshot device plugged in and recording your driving data. Your driving score is recalculated every six months, and your discount is adjusted accordingly. If your device stops transmitting data or you cancel the program, you will lose your discount. To renew your discount, simply continue participating in the program.

There’s no separate renewal process; your eligibility is automatically reviewed every six months.

Example Driving Scores and Discounts

The exact discount you receive depends on many factors and your specific driving score. The following table provides examples of potential discounts based on hypothetical driving scores:

| Driving Score | Discount Percentage | Example Premium (before discount) | Example Premium (after discount) |

|---|---|---|---|

| 90-100 | 30% | $100 | $70 |

| 70-89 | 15% | $100 | $85 |

| 50-69 | 5% | $100 | $95 |

| Below 50 | 0% | $100 | $100 |

Exclusions and Limitations

The Progressive Snapshot program, while designed to reward safe driving, isn’t a guaranteed discount for everyone. Several factors can affect eligibility and the size of the discount, and in some cases, the discount may be revoked. Understanding these limitations is crucial before enrolling. This section Artikels situations where the discount may not apply, potential restrictions, and circumstances leading to its revocation.Certain driving behaviors and circumstances aren’t compatible with the Snapshot program’s scoring system.

This means that while many drivers can benefit, some may find it doesn’t offer them the savings they expect. The program relies on objective data collected by the device, and certain limitations inherent in data collection must be considered.

Ineligible Driving Behaviors

The Snapshot program analyzes various driving metrics to assess risk. Aggressive driving habits, such as excessive speeding or hard braking, significantly impact the scoring system. Consistent risky behavior will likely result in a smaller discount or no discount at all. For example, consistently exceeding the speed limit by 15 mph or more, or frequently engaging in hard braking and acceleration, could lead to a lower score.

Similarly, frequent nighttime driving, especially in areas with higher accident rates, could negatively affect the score.

Program Limitations, Progressive Snapshot discount eligibility

The Snapshot program’s data collection is limited to the driving behavior recorded by the device. It doesn’t consider other factors that insurance companies typically use to assess risk, such as age, driving history (prior to using Snapshot), and vehicle type. For instance, a driver with a history of at-fault accidents might still qualify for Snapshot, but their pre-existing risk profile will still be factored into their overall insurance premium.

The discount offered by Snapshot is therefore an addition to, not a replacement for, Progressive’s standard risk assessment.

Discount Revocation

Progressive reserves the right to revoke the Snapshot discount under certain circumstances. This typically involves instances of fraudulent activity, such as tampering with the device or providing false information during enrollment. Furthermore, if a driver is involved in a serious accident while using the program, or if their driving habits significantly worsen, leading to a substantially lower score, the discount could be reevaluated or removed.

So you’re looking into that Progressive Snapshot discount? Your driving record is a big factor, but your credit score can also impact other car-related expenses. If you need to boost your credit before getting a loan, check out this super helpful guide on How to improve credit score before car loan to get the best rates.

A better credit score might even help you snag a better deal on your insurance, making that Progressive Snapshot discount even sweeter!

For example, a driver involved in a collision resulting in a significant claim might find their discount reduced or eliminated. Similarly, a sudden and significant drop in driving score, indicating a shift towards riskier driving behavior, could trigger a review of the discount.

Comparison with Other Programs

Progressive Snapshot isn’t the only telematics program out there; many insurers offer similar programs designed to reward safe driving. Understanding how Progressive’s program stacks up against the competition can help you make an informed decision about whether it’s the right fit for your needs. This comparison highlights key differences in eligibility, scoring, and discounts.

Several factors differentiate telematics programs. Eligibility requirements can vary widely, impacting who can participate. Scoring systems also differ, with some focusing on speed, braking, and mileage, while others may incorporate additional factors. Finally, the discount structure itself – the potential savings and how they are applied – varies significantly across providers.

So you’re trying to snag that Progressive Snapshot discount? Eligibility depends on a bunch of factors, but finding the right insurance is key. Check out this helpful guide on Best insurance for leased cars 2025 to make sure you’re getting the best rates, which could impact your Snapshot eligibility. Ultimately, securing the best deal hinges on your driving record and the insurance you choose.

Telematics Program Comparison

The following table compares Progressive Snapshot with two other popular telematics programs: State Farm Drive Safe & Save and Allstate Milewise. Note that program details are subject to change, so it’s always best to check directly with the insurance provider for the most up-to-date information.

| Feature | Progressive Snapshot | State Farm Drive Safe & Save | Allstate Milewise |

|---|---|---|---|

| Eligibility | Generally available to most drivers, with some restrictions based on age and vehicle type. | Available to most drivers, with some restrictions based on age and driving history. | Generally available to most drivers, with some restrictions based on age and vehicle type. |

| Scoring System | Scores drivers based on speed, braking, acceleration, time of day driving, and mileage. | Scores drivers based on speed, braking, acceleration, and time of day driving. | Scores drivers based on mileage driven and driving behavior (speed, acceleration, braking). |

| Discount Structure | Discounts vary based on individual driving scores, with potential savings up to 30%. | Discounts vary based on individual driving scores, with potential savings up to 30%. | Discounts vary based on mileage driven, with potential savings up to 40% for low-mileage drivers. Higher mileage may result in smaller discounts or even higher premiums. |

| Data Privacy | Progressive states it uses data to determine discounts and does not share data with third parties for marketing purposes. Specifics regarding data retention are available in their privacy policy. | State Farm’s privacy policy details their data usage practices; generally aligned with industry standards regarding telematics data usage for risk assessment. | Allstate’s privacy policy Artikels data usage and retention policies related to their Milewise program. |

Illustrative Scenarios

Let’s look at how different driving styles affect your Progressive Snapshot discount. Remember, this is a simplified illustration; the actual scoring algorithm is more complex. These examples focus on key factors to help you understand how your driving habits translate into savings.

The Snapshot program analyzes various aspects of your driving, including speed, acceleration, braking, and time of day. A higher score generally correlates to a larger discount, while a lower score might result in a smaller discount or even no discount at all.

Scenario 1: The Smooth Operator

Imagine Alex, a careful driver who consistently maintains a steady speed, accelerates and brakes gently, and avoids driving during peak traffic hours. Alex’s driving data reflects this consistent, safe behavior. Over the six-month Snapshot period, Alex receives a high score, perhaps in the top 20%, earning a significant discount on their car insurance. Their driving habits reflect a lower risk profile, thus resulting in a substantial reward.

Scenario 2: The Occasional Speed Demon

Now consider Ben, who generally drives safely but occasionally speeds, especially on highways. Ben’s score is still relatively high, but the occasional speeding infractions lower his overall score. He might fall into the middle range of drivers, earning a moderate discount. The impact of those occasional speeding tickets lowers his overall score, affecting his discount eligibility compared to Alex.

Scenario 3: The Risky Driver

Finally, let’s look at Chloe, who frequently accelerates and brakes harshly, drives aggressively, and often drives during peak traffic hours. Chloe’s driving data reflects a higher-risk profile. Her score is considerably lower than Alex’s or Ben’s, possibly putting her in the bottom quartile, resulting in a minimal or no discount. Her aggressive driving habits significantly impact her score and her potential savings.

Driver Score Progression

Imagine a graph. The horizontal axis represents time (six months of the Snapshot program), and the vertical axis represents the driver’s score. A line graph starts at a baseline score. For Alex (the smooth operator), the line steadily climbs upward, reflecting consistent good driving. For Ben (occasional speeder), the line generally trends upward but dips slightly after each speeding incident before resuming its upward trajectory.

For Chloe (risky driver), the line remains relatively flat or even declines, showing little improvement over time due to consistently risky driving behaviors. The higher the line at the end of the six months, the greater the discount.

Impact of a Single Significant Driving Event

Let’s say Ben, our occasional speed demon, receives a speeding ticket. This single event would likely cause a noticeable drop in his score, potentially reducing his discount by a few percentage points. The severity of the event (how much over the speed limit Ben was driving) will influence the magnitude of the score decrease. While a single incident won’t necessarily negate the entire discount, it does illustrate the importance of consistent safe driving habits to maximize savings.

Last Recap

So, there you have it – a comprehensive look at Progressive Snapshot discount eligibility. By understanding how the program works, you can optimize your driving habits to maximize your savings. Remember, it’s all about consistent safe driving. No need to become a robot behind the wheel, but consistently avoiding risky behaviors will keep those discounts rolling in. Think of it as a win-win: safer driving habits

-and* a fatter wallet.

Now get out there and drive smart!