Navy Federal car loan rates for used cars are a hot topic for anyone looking to buy a pre-owned ride. Getting a loan can be a total headache, but understanding the ins and outs of Navy Federal’s program can make the process way smoother. This guide breaks down everything you need to know, from eligibility requirements and interest rate factors to comparing them with other lenders and understanding repayment schedules.

Let’s dive in!

We’ll cover what influences your interest rate – things like your credit score, the loan amount, the car’s age, and even the loan term. We’ll also compare Navy Federal’s rates to those of other major lenders so you can make the best decision for your wallet. Plus, we’ll walk you through example repayment scenarios to give you a clear picture of what to expect.

Think of this as your ultimate cheat sheet for navigating the world of Navy Federal used car loans.

Understanding Navy Federal’s Used Car Loan Program

So you’re thinking about buying a used car and financing it through Navy Federal Credit Union? Smart move! Navy Federal offers competitive rates and a relatively straightforward application process, but understanding the specifics is key to a smooth experience. This section will break down the essentials of their used car loan program.

Eligibility Criteria for Navy Federal Used Car Loans

To qualify for a Navy Federal used car loan, you’ll need to meet certain criteria. These typically include membership eligibility (you or a family member must be eligible for membership), a satisfactory credit history, and sufficient income to comfortably manage loan payments. Specific requirements can vary depending on the loan amount and the type of vehicle. It’s always best to check directly with Navy Federal for the most up-to-date information, as requirements can change.

They’ll assess your financial situation to determine your eligibility.

Types of Used Vehicles Financed

Navy Federal generally finances a wide range of used vehicles, including cars, trucks, SUVs, and vans. There might be limitations on the age and mileage of the vehicle, and certain types of vehicles (like heavily modified vehicles or those with salvage titles) may not be eligible. Again, it’s advisable to contact Navy Federal directly to confirm which vehicles are eligible for financing under their program.

Required Documentation for Application

Applying for a used car loan with Navy Federal requires several key documents. You’ll typically need proof of income (pay stubs or tax returns), your driver’s license or other government-issued ID, and information about the vehicle you intend to purchase (like the VIN number and the seller’s information). You might also need proof of residence and your credit report.

Having all this documentation ready beforehand will streamline the application process significantly.

Step-by-Step Application Process

The application process is generally straightforward. First, you’ll need to pre-qualify online or visit a branch to get a rate quote. This involves providing some basic financial information. Once pre-qualified, you can formally apply for the loan. Next, Navy Federal will review your application and required documentation.

If approved, you’ll receive a loan offer outlining the terms and conditions. Finally, you’ll sign the loan documents and receive the funds to purchase your used vehicle. Remember, the exact steps and timelines may vary.

Factors Influencing Navy Federal Used Car Loan Rates

Securing a used car loan from Navy Federal involves several factors that determine your interest rate. Understanding these factors can help you better prepare for the application process and potentially secure a more favorable rate. The better prepared you are, the smoother the process will be.

Credit Score’s Impact on Interest Rates

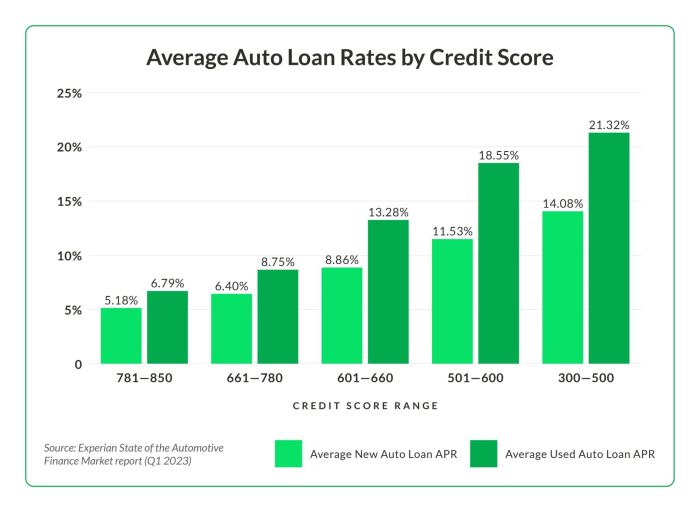

Your credit score is arguably the most significant factor influencing your interest rate. Lenders like Navy Federal use your credit score to assess your creditworthiness – essentially, how likely you are to repay the loan. A higher credit score (generally 700 or above) typically translates to a lower interest rate, reflecting lower risk for the lender. Conversely, a lower credit score (below 600) will likely result in a higher interest rate, reflecting a higher perceived risk.

For example, a borrower with a credit score of 750 might qualify for a rate of 5%, while a borrower with a 620 score might receive a rate closer to 8%. These are illustrative examples, and actual rates will vary based on other factors.

Loan Amount and Loan Term’s Influence

The amount you borrow and the length of your loan term also affect your interest rate. Borrowing a larger amount generally means a higher interest rate, as it represents a greater risk to the lender. Similarly, longer loan terms (e.g., 72 months versus 36 months) usually come with higher interest rates because the lender is exposed to the risk of default for a longer period.

Think of it this way: a shorter loan term means you pay back the loan faster, reducing the lender’s overall risk.

So you’re looking at Navy Federal car loan rates for used cars? Getting pre-approved is key, especially since you’ll also need to factor in insurance costs. Understanding your insurance needs is super important, and checking out this helpful guide on Florida PIP insurance explained 2025 will give you a better grasp of those costs before you finalize your car loan with Navy Federal.

Knowing your insurance will help you budget better for your used car purchase.

Vehicle Age and Condition’s Role

The age and condition of the used vehicle you’re financing influence the interest rate, although perhaps less directly than your credit score. Navy Federal will likely assess the vehicle’s value as collateral. Older vehicles or those in poor condition may be viewed as less valuable collateral, potentially leading to a higher interest rate. This is because the lender’s potential recovery in case of default is reduced.

A newer vehicle in excellent condition provides stronger collateral, often leading to a better rate. The appraisal process helps determine the vehicle’s value and its impact on the loan.

Comparing Navy Federal Rates with Competitors

Shopping for a used car loan can feel like navigating a minefield, especially when trying to decipher interest rates. While Navy Federal Credit Union often boasts competitive rates for its members, it’s crucial to compare their offerings with other major lenders to ensure you’re getting the best deal. This comparison will highlight scenarios where Navy Federal shines and where other lenders might offer a more advantageous rate.

Direct comparison of loan rates requires specific details like credit score, loan amount, and vehicle type. However, we can illustrate general trends using publicly available information and common loan scenarios. Keep in mind that rates are constantly fluctuating, so these examples represent snapshots in time and should be verified with each lender directly before making a decision.

Rate Comparison Table

The following table compares Navy Federal’s estimated used car loan rates with those of three major competitors—USAA, Capital One Auto Navigator, and Bank of America. Remember that these are estimates and your actual rate will depend on your individual financial profile.

| Lender | APR (Estimate) | Loan Term Options (Years) | Fees |

|---|---|---|---|

| Navy Federal | 5.5% – 12% | 24, 36, 48, 60, 72 | Origination fee may apply; varies by loan |

| USAA | 6% – 13% | 24, 36, 48, 60, 72 | Origination fee may apply; varies by loan |

| Capital One Auto Navigator | 6.5% – 14% | 24, 36, 48, 60 | Origination fee may apply; varies by loan |

| Bank of America | 7% – 15% | 24, 36, 48, 60, 72 | Origination fee may apply; varies by loan |

Scenarios Favoring Navy Federal

Navy Federal’s rates tend to be most competitive for members with excellent credit scores and a history of responsible borrowing within the credit union. For example, a member with a 780+ credit score seeking a $20,000 loan might secure a rate significantly lower than what’s offered by other lenders. Their membership benefits and potential for discounted rates due to long-standing relationships also provide an advantage.

Scenarios Favoring Competitors

Borrowers with less-than-perfect credit scores may find more favorable rates with lenders specializing in subprime auto loans. Capital One, for instance, often caters to a broader range of credit profiles, potentially offering more competitive rates for individuals with lower credit scores than those typically served by Navy Federal. Similarly, specific promotions or special financing offers from Bank of America or USAA at certain times of the year could temporarily make their rates more attractive than Navy Federal’s.

Illustrating Loan Repayment Scenarios: Navy Federal Car Loan Rates For Used Cars

Let’s look at some example repayment schedules for Navy Federal used car loans to illustrate how different loan amounts, interest rates, and loan terms affect your monthly payments and total interest paid. Remember, these are examples and your actual loan terms will depend on your creditworthiness and the specific details of your loan application.Understanding these scenarios can help you make informed decisions about your car purchase and financing options.

So you’re looking at Navy Federal car loan rates for used cars? That’s smart! Securing financing is key, especially if you’re planning a purchase. Finding the right rate is important, but don’t forget about insurance; if you’re over 70 in Florida, check out this resource for car insurance options: Car insurance for seniors over 70 in Florida.

Once you’ve got your insurance sorted, you can focus back on those sweet Navy Federal used car loan rates.

It’s crucial to consider the total cost of the loan, not just the monthly payment, to ensure you can comfortably afford the vehicle.

Loan Repayment Scenario 1: Lower Amount, Lower Rate, Shorter Term

This scenario represents a smaller loan amount with a favorable interest rate and a shorter repayment period. This often results in lower overall interest paid.

| Month | Beginning Balance | Payment Amount | Ending Balance | Interest Paid |

|---|---|---|---|---|

| 1 | $10,000.00 | $300.00 | $9,700.00 | $50.00 |

| 2 | $9,700.00 | $300.00 | $9,400.00 | $48.50 |

| 3 | $9,400.00 | $300.00 | $9,100.00 | $47.00 |

| … | … | … | … | … |

| 36 | $300.00 | $300.00 | $0.00 | $2.50 |

Total Interest Paid (Approximate): $1000.00

(Note

This is a simplified example. Actual interest calculations will vary slightly.)*

Loan Repayment Scenario 2: Higher Amount, Higher Rate, Longer Term

This scenario demonstrates a larger loan amount, a higher interest rate, and a longer repayment period. As expected, this results in significantly higher overall interest paid.

| Month | Beginning Balance | Payment Amount | Ending Balance | Interest Paid |

|---|---|---|---|---|

| 1 | $25,000.00 | $500.00 | $24,500.00 | $125.00 |

| 2 | $24,500.00 | $500.00 | $24,000.00 | $122.50 |

| 3 | $24,000.00 | $500.00 | $23,500.00 | $120.00 |

| … | … | … | … | … |

| 72 | $500.00 | $500.00 | $0.00 | $2.50 |

Total Interest Paid (Approximate): $7000.00

(Note

This is a simplified example. Actual interest calculations will vary slightly.)*

Loan Repayment Scenario 3: Medium Amount, Average Rate, Medium Term

This scenario provides a middle ground, illustrating a loan with a moderate amount, interest rate, and repayment term. This serves as a comparison point between the other two scenarios.

| Month | Beginning Balance | Payment Amount | Ending Balance | Interest Paid |

|---|---|---|---|---|

| 1 | $15,000.00 | $400.00 | $14,600.00 | $75.00 |

| 2 | $14,600.00 | $400.00 | $14,200.00 | $73.00 |

| 3 | $14,200.00 | $400.00 | $13,800.00 | $71.00 |

| … | … | … | … | … |

| 48 | $400.00 | $400.00 | $0.00 | $2.00 |

Total Interest Paid (Approximate): $2500.00

(Note

This is a simplified example. Actual interest calculations will vary slightly.)*

Exploring Additional Loan Features and Fees

Securing a used car loan with Navy Federal involves more than just the interest rate. Understanding the additional fees, payment options, and loan flexibility is crucial for a smooth and financially responsible car-buying experience. Let’s dive into the details to ensure you’re fully informed.

While Navy Federal generally doesn’t advertise application or origination fees for used car loans, it’s always best to confirm directly with them. Their policies can change, and specific fees might depend on factors like your credit score and the loan amount. It’s smart to ask about any potential hidden costs upfront to avoid surprises later in the process.

Transparency is key when it comes to borrowing money, so don’t hesitate to be thorough in your inquiries.

Loan Payment Methods

Navy Federal offers various convenient methods for making your loan payments. You can easily manage your payments online through their website or mobile app, offering a streamlined and trackable process. Alternatively, you can opt for the traditional method of mailing in your payment. For those who prefer in-person interactions, you might be able to make payments at a local branch, but this should be confirmed beforehand.

Choosing the method that best suits your lifestyle and preferences is essential for timely and efficient repayment.

Loan Prepayment and Refinancing Options, Navy Federal car loan rates for used cars

Navy Federal allows for early loan repayment without penalty. This means you can pay off your loan ahead of schedule without incurring additional charges. This can be beneficial if you receive a bonus or windfall, allowing you to save on interest payments over the life of the loan. Refinancing your existing Navy Federal auto loan is also a possibility, potentially lowering your monthly payment or interest rate if your financial situation improves or interest rates fall.

Contacting Navy Federal directly will provide the most accurate and up-to-date information on eligibility and procedures.

Insurance Requirements

Navy Federal, like most lenders, requires you to maintain comprehensive and collision insurance on your used vehicle throughout the loan term. This protects both you and the lender in case of accidents or damage. Failure to maintain adequate insurance coverage could result in penalties or even loan default. Proof of insurance is typically required at the time of loan disbursement and may need to be periodically verified.

Contact your insurance provider and Navy Federal to understand the specific insurance requirements and how to provide proof of coverage.

Visual Representation of Interest Rate Variations

Understanding the factors that influence Navy Federal’s used car loan rates requires visualizing the data. Two key factors – credit score and loan term – significantly impact the interest rate you’ll receive. The following descriptions illustrate how these factors are visually represented.

Visualizing the relationship between credit score and interest rate is crucial for understanding how your financial history affects the cost of borrowing. A scatter plot would effectively demonstrate this relationship.

Credit Score and Interest Rate Relationship

The scatter plot would have the credit score on the x-axis, ranging from 300 to 850, representing the typical credit score range. The y-axis would represent the annual percentage rate (APR), ranging from, for example, 6% to 18%, reflecting a plausible range for used car loans. Each data point on the graph would represent a specific borrower’s credit score and the corresponding APR they received on a used car loan from Navy Federal.

The data points would generally show a negative correlation; as the credit score increases, the APR tends to decrease. A line of best fit could be added to the graph to further highlight this trend, showing the general downward slope illustrating that borrowers with higher credit scores typically secure lower interest rates. Individual data points might show some variation around the line of best fit due to other influencing factors, but the overall trend would be clear.

Another important visualization is the impact of the loan term on the total interest paid. This helps borrowers understand the long-term financial implications of choosing a shorter or longer repayment period.

Loan Term and Total Interest Paid

A bar graph would effectively illustrate the relationship between loan term and total interest paid. The x-axis would represent different loan terms (e.g., 36 months, 48 months, 60 months, 72 months). The y-axis would represent the total interest paid over the life of the loan. Each bar would represent a specific loan term, with its height corresponding to the total interest paid for that term.

Assuming a consistent loan amount and APR, the graph would clearly show that longer loan terms result in significantly higher total interest paid. For example, a $20,000 loan at a 7% APR would show a much higher total interest paid over 72 months compared to a 36-month term. The difference in total interest paid would be visually striking, emphasizing the financial advantage of shorter loan terms despite potentially higher monthly payments.

Concluding Remarks

So, there you have it – a pretty comprehensive look at Navy Federal used car loan rates. Remember, getting pre-approved can be a game-changer, and comparing rates from different lenders is key to finding the best deal. Don’t be afraid to shop around and ask questions! With a little research, you can snag a sweet used car without breaking the bank.

Happy car hunting!