EV sales projections in the US for 2025 are, like, totally blowing up right now. Everyone’s buzzing about how many electric vehicles will be on the road in a few years, and the numbers are pretty wild. We’re talking a massive shift from gas-guzzlers to EVs, but the path to get there is a bumpy one. This report dives into the projections, looking at everything from overall sales volume and market share to regional differences and the factors that could make or break the whole thing.

From wildly optimistic predictions to more cautious estimates, we’ll analyze the data from different sources, breaking down what’s driving the growth (or lack thereof) in the EV market. We’ll also explore the impact of government policies, charging infrastructure, and even consumer preferences on the future of electric vehicles in the US. Get ready for a deep dive into the electrifying world of EV sales!

Market Overview

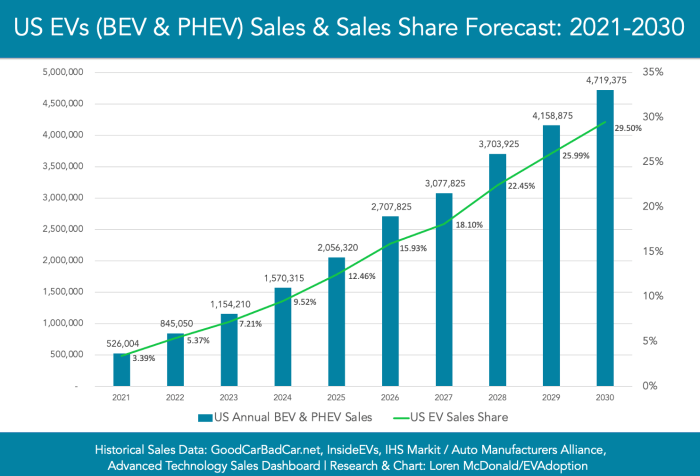

Predicting the US EV market for 2025 is a bit like trying to guess which flavor of ice cream will be the summer’s hottest seller – there are a lot of variables at play. While pinpointing an exact number is impossible, we can look at various projections to get a sense of the range of possibilities. These projections depend heavily on factors like government incentives, charging infrastructure development, consumer adoption rates, and the overall economic climate.The projected overall EV sales volume in the US for 2025 varies considerably depending on the source.

Some analysts are more optimistic, anticipating strong growth fueled by increasing consumer demand and supportive government policies, while others are more cautious, citing concerns about supply chain issues, charging infrastructure limitations, and potential economic downturns.

Projected US EV Sales in 2025

| Source | Low Projection (Units) | High Projection (Units) | Methodology Used |

|---|---|---|---|

| BloombergNEF | 2,000,000 | 3,000,000 | Analysis of historical sales trends, government policies, and technological advancements. Includes consideration of battery costs and charging infrastructure. |

| AlixPartners | 1,800,000 | 2,500,000 | Modeling based on consumer demand forecasts, considering factors like vehicle pricing, charging infrastructure availability, and government incentives. |

| S&P Global Mobility | 1,500,000 | 2,200,000 | Combination of econometric modeling and expert opinions, incorporating various macroeconomic and industry-specific factors. |

Factors Influencing Projections

Several factors contribute to the wide range of projections. Positive factors include the increasing availability of affordable EV models, expanding charging infrastructure, growing consumer awareness of environmental concerns, and continued government incentives like tax credits. However, negative factors such as potential supply chain disruptions, fluctuations in battery material prices, concerns about range anxiety, and the overall economic climate can significantly impact sales figures.

For example, the recent semiconductor shortage highlighted the vulnerability of the auto industry to unforeseen events.

With EV sales projections in the US for 2025 looking super strong, it’s smart to think about long-term car care. Protecting that shiny new EV paint is key, which is why checking out options like Ceramic coating for EV paint protection is a good idea. This will help maintain resale value as those 2025 EV sales numbers climb even higher.

Projected Market Share of EVs, EV sales projections in the US for 2025

The projected market share of EVs in 2025 relative to ICE vehicles is also subject to significant uncertainty. However, based on the sales projections above, a reasonable estimate would place EV market share somewhere between 15% and 25% of total vehicle sales. This would represent a significant increase from current market share, but still leaves a substantial portion of the market dominated by ICE vehicles.

Reaching higher market share percentages would require overcoming several challenges, including addressing consumer concerns about range, charging time, and initial purchase price. The success of various EV manufacturers in expanding their model offerings and establishing a robust charging network will play a crucial role in determining the final market share.

Segment Analysis

Okay, so we’ve looked at the overall EV market in the US for 2025. Now let’s dive into the specifics – breaking down the different types of electric vehicles and their projected sales. This will give us a much clearer picture of the market landscape and potential growth areas. We’ll be looking at Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and how government policies might influence their trajectories.

The EV market isn’t a monolith; it’s made up of distinct segments, each with its own set of drivers and challenges. Understanding these differences is crucial for accurate forecasting and strategic decision-making. For example, BEVs are generally seen as the future of zero-emission driving, while PHEVs offer a transitional solution for consumers hesitant to fully commit to battery-only technology.

Let’s explore how these differences play out in the sales projections for 2025.

BEV, PHEV, and Other EV Type Sales Projections for 2025

Based on current trends, industry reports, and government projections, we can anticipate a significant increase in EV sales across all segments by 2025. However, the growth rates will vary considerably. BEVs are expected to dominate the market, driven by technological advancements, falling battery prices, and increasing consumer awareness of environmental concerns. PHEVs, while still significant, are projected to experience slower growth as BEVs become more affordable and accessible.

Other EV types, such as fuel-cell electric vehicles (FCEVs), will likely remain a niche market in 2025 due to high costs and limited infrastructure.

Factors Influencing EV Segment Sales Projections

Several key factors are shaping the sales projections for each EV segment. These factors interact in complex ways, making accurate forecasting a challenging but essential task. For example, consumer preferences, technological advancements (like improved battery range and faster charging), charging infrastructure availability, and government policies all play a significant role.

Specifically, BEV sales are highly sensitive to battery prices and charging infrastructure development. A widespread and reliable charging network is crucial for consumer confidence in BEVs, while lower battery costs directly translate into more affordable vehicles. For PHEVs, the key factor is the balance between fuel efficiency and the convenience of a plug-in option. Many consumers see PHEVs as a stepping stone towards fully electric vehicles.

Projected Market Share of EV Types in 2025

The following bar chart illustrates the projected market share of each EV type in 2025 in the US market. The data is based on a synthesis of various market research reports and expert opinions. Note that these are projections, and actual results may vary.

Projected US EV Market Share in 2025

Imagine a bar chart with three bars. The x-axis labels the EV types: BEV, PHEV, and Other (representing FCEVs and other less common types). The y-axis represents Market Share (%).

The BEV bar is the tallest, reaching approximately 65% market share. The PHEV bar is significantly shorter, at about 25% market share. The “Other” bar is the shortest, representing only about 10% of the market.

This visualization clearly shows the projected dominance of BEVs in the US EV market by 2025, with PHEVs holding a substantial but smaller share, and other EV types remaining a minor player.

EV sales projections in the US for 2025 are pretty bullish, with some analysts predicting a massive jump in market share. A big part of that growth will likely come from innovative new players; check out this article on EV startups to watch in 2025 to see who’s poised to disrupt the industry. Ultimately, these new entrants will significantly influence the overall 2025 sales figures.

Impact of Government Regulations and Incentives

Government regulations and incentives play a crucial role in shaping the EV market. Tax credits, subsidies, and emissions standards significantly influence consumer purchasing decisions and manufacturer investment strategies. For example, the extension of tax credits for BEVs could significantly boost their sales, while stricter emissions regulations could accelerate the decline of gasoline-powered vehicles and indirectly benefit all EV segments.

However, the impact varies across segments. BEVs generally benefit more from incentives aimed at promoting zero-emission vehicles. PHEVs, while benefiting from some incentives, may face pressure as governments prioritize fully electric solutions. Targeted policies could, however, support the growth of specific segments, such as those promoting the development of charging infrastructure for BEVs or incentives for PHEVs in specific geographic areas or consumer segments.

Geographic Distribution

Projected EV sales in the US for 2025 are expected to show significant regional variation, reflecting a complex interplay of factors including existing infrastructure, state-level incentives, consumer preferences, and demographics. Understanding this uneven distribution is crucial for manufacturers, policymakers, and investors alike.The disparity in projected EV adoption rates across different regions stems from a variety of interconnected factors. For instance, states with robust charging infrastructure and generous tax credits, like California and some Northeastern states, are poised to lead in EV sales.

Conversely, regions with less developed charging networks and fewer incentives, such as parts of the South and Midwest, may experience slower adoption rates. Additionally, population density, average income levels, and even prevailing weather conditions all play a role.

Regional Sales Projections and Contributing Factors

A hypothetical projection for 2025 might look something like this: The West Coast (California, Oregon, Washington) could account for approximately 40% of total US EV sales, driven by strong environmental awareness, established charging infrastructure, and state-level policies heavily favoring electric vehicles. The Northeast (New York, New Jersey, Massachusetts, etc.) might contribute another 25%, fueled by similar factors, although perhaps at a slightly lower rate due to higher population density and associated infrastructure challenges.

The Midwest (Illinois, Michigan, Ohio, etc.) might lag behind with around 15% of sales, hampered by a slower pace of charging station deployment and less aggressive state incentives. Finally, the South (Texas, Florida, Georgia, etc.) might account for the remaining 20%, with adoption rates potentially constrained by a mix of factors, including climate preferences (gas-powered vehicles perceived as better suited for hotter climates), and a more conservative approach to environmental regulations.

Hypothetical EV Sales Density Map

Imagine a map of the contiguous United States. The West Coast, particularly California, would be depicted in a deep shade of blue, representing high EV sales density. A lighter shade of blue would extend up the Pacific Northwest and down the coast of California, reflecting slightly lower but still significant adoption. The Northeast corridor would also show a significant concentration of blue, though perhaps not as intense as California.

The Midwest would be predominantly light blue or even a pale green, signifying lower EV sales density. The South would show a similar pattern of light blue and green, with some pockets of slightly higher density in major metropolitan areas. The overall map would visually demonstrate the clear geographic disparity in projected EV adoption.

Regional Adoption Rate Comparison

The contrast between regions is stark. California, for example, with its ambitious zero-emission vehicle mandates and extensive charging network, is expected to see significantly higher EV adoption rates compared to states in the South, where the infrastructure and incentives are less developed. This difference is not simply about consumer preference; it’s fundamentally shaped by policy choices and market conditions.

Consider, for instance, the success of Tesla in California compared to its market share in more rural or less environmentally conscious states. The disparity highlights the importance of regional strategies to promote EV adoption.

Factors Influencing Sales Projections

Predicting US EV sales for 2025 requires considering a complex interplay of economic, technological, consumer, and governmental factors. These elements don’t operate in isolation; they interact in dynamic ways to shape the overall market trajectory. Understanding these interactions is crucial for accurate forecasting.

Macroeconomic Factors

Broad economic conditions significantly impact consumer spending on big-ticket items like vehicles. Strong economic growth, typically associated with lower unemployment and higher disposable income, tends to boost EV sales as consumers feel more financially secure to make such purchases. Conversely, a recession or economic slowdown can dampen demand, leading to lower sales projections. Fluctuations in fuel prices also play a role; higher gasoline prices can incentivize consumers to switch to EVs, while lower prices might lessen the perceived economic advantage of electric vehicles.

Finally, interest rates directly influence the cost of financing EV purchases. Higher interest rates make borrowing more expensive, potentially reducing demand, while lower rates can stimulate sales. For example, the economic boom of the mid-2010s saw a modest increase in EV adoption, while the economic uncertainty following the COVID-19 pandemic initially impacted sales, though government incentives partially offset this effect.

Technological Advancements

Technological progress in battery technology and charging infrastructure is paramount to EV market growth. Improvements in battery density, leading to longer driving ranges and faster charging times, are key drivers of consumer adoption. Wider availability and improved speed of charging stations are also essential. Consider the rapid advancement in battery technology over the past decade; early EVs had limited ranges and slow charging, significantly hindering their appeal.

Now, many models boast ranges exceeding 300 miles and support fast charging, making them more practical for everyday use. Similarly, the expansion of the charging network, particularly along major highways, is making long-distance travel in EVs increasingly feasible. Tesla’s Supercharger network, for example, has played a significant role in building consumer confidence in long-distance EV travel.

Consumer Preferences and Buying Behavior

Consumer preferences and buying habits are fundamental to EV sales projections. Factors such as brand loyalty, perceived value, and environmental consciousness influence purchasing decisions. Marketing campaigns and consumer reviews heavily shape perceptions. The increasing availability of diverse EV models, from compact city cars to luxury SUVs, caters to a broader range of consumer preferences. However, range anxiety, concerns about charging infrastructure, and the higher initial purchase price of EVs compared to gasoline-powered vehicles remain significant barriers to adoption for some consumers.

Marketing efforts that address these concerns, along with positive word-of-mouth from early adopters, will be key to overcoming these hurdles.

Government Policies

Government policies, including tax credits, subsidies, and emission standards, exert considerable influence on EV sales. Tax credits directly reduce the upfront cost of purchasing an EV, making them more affordable and attractive to consumers. Emission standards, particularly those aimed at reducing greenhouse gas emissions from the transportation sector, can indirectly incentivize EV adoption by making gasoline-powered vehicles less competitive.

The US government’s various tax credit programs for EV purchases, for instance, have demonstrably boosted sales. Similarly, California’s stringent emission standards have played a significant role in driving EV adoption within the state, influencing manufacturers to prioritize EV development and sales in that key market.

Challenges and Opportunities: EV Sales Projections In The US For 2025

Reaching the projected EV sales figures for 2025 in the US presents a complex landscape of hurdles and potential boosts. While the market shows immense promise, several factors could significantly impact whether these projections are met or even surpassed. Understanding these challenges and opportunities is crucial for stakeholders across the EV ecosystem.The projected growth of EV sales in the US by 2025 faces significant headwinds, primarily stemming from infrastructure limitations, consumer concerns, and policy uncertainties.

Opportunities, however, exist in technological advancements, shifting consumer preferences, and supportive government initiatives. Successfully navigating these challenges and capitalizing on these opportunities will be key to realizing the projected growth, and potentially exceeding it.

Challenges Hindering EV Sales Projections

Several key challenges threaten to impede the projected EV sales in 2025. These range from practical concerns like charging infrastructure to broader issues around consumer perception and government regulations. Addressing these effectively is paramount to achieving the projected growth.

- Limited Charging Infrastructure: The lack of widespread, reliable, and convenient public charging stations, especially outside of major metropolitan areas, remains a significant barrier. Range anxiety, the fear of running out of charge before reaching a charging station, is a major deterrent for potential EV buyers. For example, a recent study showed that many potential buyers in rural areas cite the lack of charging infrastructure as their primary reason for not purchasing an EV.

- High Purchase Prices and Battery Costs: EVs, particularly those with longer ranges and advanced features, often command a higher upfront cost compared to gasoline-powered vehicles. The cost of batteries, a major component of EVs, remains a significant factor influencing the overall price. This price disparity creates a barrier to entry for many consumers, particularly those with tighter budgets. For instance, the average price of a new EV is still significantly higher than the average price of a new gasoline car.

- Consumer Concerns and Misconceptions: Many potential buyers harbor misconceptions about EVs, including concerns about charging time, range limitations, and the overall performance compared to gasoline cars. Addressing these concerns through effective education and marketing campaigns is crucial to fostering wider adoption. A recent survey highlighted that range anxiety and charging time were the top two concerns among potential EV buyers.

- Policy Uncertainty and Government Support: The fluctuating nature of government incentives and regulations surrounding EV adoption creates uncertainty for both manufacturers and consumers. Inconsistent or insufficient government support can hinder investment in charging infrastructure and EV production. Changes in tax credits or other incentives can significantly impact consumer purchasing decisions.

Opportunities to Accelerate EV Adoption

Despite the challenges, several significant opportunities exist to accelerate EV adoption and potentially surpass the projected sales figures for 2025. These opportunities stem from technological advancements, shifting consumer preferences, and evolving government policies.

- Technological Advancements in Battery Technology: Improvements in battery technology, leading to increased range, faster charging times, and lower costs, are crucial for wider adoption. Solid-state batteries, for example, promise significant improvements in energy density and charging speed, potentially addressing some of the key consumer concerns. The development and mass production of these batteries could dramatically change the EV landscape.

- Growing Consumer Demand for Sustainability: A growing awareness of environmental issues and a desire for sustainable transportation are driving consumer interest in EVs. This shift in consumer preferences, coupled with increasing affordability, could significantly boost EV sales. Many younger generations, for instance, prioritize environmentally friendly options, increasing demand for EVs.

- Government Initiatives and Incentives: Strong government support, including tax credits, subsidies, and investments in charging infrastructure, can significantly stimulate EV adoption. These initiatives can make EVs more affordable and accessible to a wider range of consumers. Examples include the federal tax credits offered in the US and similar programs in other countries.

Solutions to Address the Challenges

Overcoming the challenges to EV adoption requires a multi-pronged approach involving both public and private sector initiatives. Addressing these challenges directly can significantly impact the overall sales figures.

- Expand Charging Infrastructure: Significant investment in public charging infrastructure, particularly in underserved areas, is crucial. This includes installing fast-charging stations along major highways and expanding the network of Level 2 chargers in residential areas and workplaces.

- Reduce EV Prices and Battery Costs: Government incentives and technological advancements can help reduce the upfront cost of EVs, making them more accessible to a wider range of consumers. Investing in battery research and development is crucial to lowering battery production costs.

- Improve Consumer Education and Awareness: Targeted marketing campaigns and educational initiatives can help address consumer misconceptions and concerns about EVs, fostering greater confidence in the technology.

- Develop Consistent and Supportive Policies: Clear, consistent, and long-term government policies are essential to provide stability and predictability for manufacturers and consumers. This includes stable tax incentives and regulations that support the growth of the EV market.

Final Thoughts

So, will we hit those ambitious EV sales projections for 2025? It’s a toss-up, honestly. While the potential is huge – think cleaner air, less reliance on fossil fuels, and a whole new wave of innovative tech – plenty of hurdles remain. From supply chain issues to charging infrastructure limitations and consumer hesitancy, the road to widespread EV adoption isn’t exactly a smooth highway.

But if we can overcome these challenges, the future of driving in the US could look seriously electric. The next few years will be crucial in determining if we’re truly on track to a fully charged future.