EV Sales Projections in the US for 2025: It’s a hot topic, right? Everyone’s buzzing about electric vehicles, and trying to figure out just how many will be on the road in a few short years. Will Tesla still dominate? Will other brands catch up? This deep dive looks at the projected market share for major players, regional differences in sales, the impact of government policies, and even consumer preferences – the whole shebang.

Get ready to plug in to some seriously interesting data.

We’ll explore everything from projected market share breakdowns for top EV brands and regional sales variations across the US to the influence of consumer preferences and government incentives. We’ll also look at how technological advancements and the expansion of charging infrastructure are expected to shape the future of EV adoption in the US. The analysis will include comparisons with ICE vehicle sales, a look at pricing and affordability, and a discussion of the challenges and barriers to wider EV adoption.

Market Share Projections for EV Brands in 2025

Predicting the future of the EV market is always a bit of a gamble, but based on current trends, available models, and announced production plans, we can make some educated guesses about market share in 2025. Several factors, including government incentives, charging infrastructure improvements, and the increasing affordability of EVs, will significantly impact the results. These projections should be viewed as estimates, not definitive predictions.

Projected Market Share Breakdown for Major EV Brands in 2025

The following table offers a projected market share breakdown for major EV brands in the US for 2025. These projections consider current production capacity, planned expansions, and anticipated consumer demand. It’s important to remember that unforeseen circumstances, such as supply chain disruptions or unexpected technological breakthroughs, could significantly alter these numbers.

| Brand | Projected Market Share (%) | Sales Volume (estimated) | Key Model Contributing to Sales |

|---|---|---|---|

| Tesla | 25 | 750,000 | Model Y, Model 3 |

| Ford | 15 | 450,000 | F-150 Lightning, Mustang Mach-E |

| GM (Chevrolet, Buick, GMC, Cadillac) | 12 | 360,000 | Chevrolet Bolt, GMC Hummer EV |

| Rivian | 5 | 150,000 | R1T, R1S |

| Other (includes Hyundai, Kia, Volkswagen, etc.) | 43 | 1,290,000 | Various models across multiple brands |

Factors Driving Projected Market Share

Tesla’s projected dominance stems from its established brand recognition, extensive Supercharger network, and a diverse model lineup catering to various consumer needs. Ford’s strong showing is fueled by the popularity of the F-150 Lightning, leveraging its existing truck market dominance. GM’s market share is projected to remain robust due to its diverse portfolio and established dealer network. Rivian’s projection reflects its anticipated ramp-up in production and strong demand for its adventure-focused vehicles.

The “Other” category encompasses a large number of brands, reflecting the increasingly competitive nature of the EV market. This segment’s growth is expected due to new model releases and expanding charging infrastructure.

Comparison with Previous Years’ Sales Data

Comparing these projections to 2023 sales data reveals a significant upward trend in overall EV sales. While precise figures vary depending on the source, the overall growth trajectory points towards a rapid expansion of the EV market in the US. For instance, Tesla’s market share has shown some fluctuation in recent years, but its overall sales volume has steadily increased.

The entry and success of new players like Rivian showcase the market’s dynamic nature and potential for disruption. This growth trajectory is expected to continue into 2025, although the exact market share distribution amongst brands might shift. The increased competition will likely lead to further innovation and price reductions, ultimately benefiting consumers.

Regional Sales Variations Across the US

Predicting EV sales in 2025 requires considering more than just national totals; regional disparities will significantly impact the overall market. Factors like charging infrastructure availability, state-level incentives, and consumer preferences based on local demographics and driving habits will lead to uneven distribution across the country. This analysis explores these regional variations, offering a projected sales breakdown and identifying key contributing factors.

Our projected map of EV sales distribution in 2025 shows a clear concentration in the West and Northeast regions. The West Coast, particularly California, is expected to lead in EV adoption due to its strong environmental consciousness, established charging networks, and early adoption of zero-emission vehicle policies. The Northeast, while facing some challenges with charging infrastructure in more rural areas, benefits from a dense population, supportive state regulations, and a higher concentration of affluent consumers who can afford EVs.

Conversely, the Southeast and Midwest show lower projected sales, primarily due to factors like lower population density, less developed charging infrastructure, and a greater reliance on gasoline-powered vehicles. The Southwest shows moderate growth, driven by a growing population and a mix of urban and rural areas with varying levels of EV infrastructure development.

Projected EV Sales by Region in 2025

The following table presents a projected breakdown of EV sales by region, reflecting the variations discussed above. These projections are based on current market trends, projected growth rates, and consideration of regional influencing factors. For example, the strong growth predicted for California is extrapolated from its current market leadership and continued investment in EV infrastructure and incentives. Conversely, the slower growth in the Midwest reflects the current slower adoption rates and the need for greater investment in charging infrastructure in that region.

These projections are illustrative and subject to change based on unforeseen market shifts.

| Region | Projected Sales Volume (Units) | Market Share (%) |

|---|---|---|

| West | 1,200,000 | 35% |

| Northeast | 800,000 | 23% |

| Midwest | 400,000 | 12% |

| Southeast | 500,000 | 15% |

| Southwest | 600,000 | 17% |

| Total | 3,500,000 | 100% |

Impact of Government Policies and Incentives

Government policies play a significant role in shaping the EV market. Federal and state-level incentives, alongside emissions regulations, are projected to heavily influence the number of EVs sold in the US by 2025. The effectiveness of these policies varies considerably depending on their design and implementation across different states.The success of the federal tax credit, for example, hinges on factors like eligibility requirements and the credit’s monetary value.

State-level policies, such as rebates and zero-emission vehicle (ZEV) mandates, further contribute to a complex landscape affecting consumer purchasing decisions and manufacturer investment strategies. These policies, while intended to accelerate EV adoption, can also create uneven market growth across the country.

Federal Tax Credits and their Projected Impact

The federal tax credit for EVs, while currently facing modifications, is expected to remain a substantial driver of sales in 2025. The credit, initially offering up to $7,500, has been modified to include stipulations such as battery component sourcing and vehicle assembly location. These changes are intended to boost domestic manufacturing and supply chains. However, the impact on sales will depend on how effectively these new requirements are implemented and whether they limit access for a significant portion of consumers.

With EV sales projections in the US for 2025 looking pretty bullish, it’s smart to think ahead. You’ll want to protect your investment, right? So check out this guide on Best dash cams for electric cars 2025 to find the perfect one for your future ride. As more EVs hit the road, having a dash cam becomes even more crucial for peace of mind, especially given the rising number of accidents.

Those 2025 EV sales projections are gonna mean more cars on the road!

For example, a study by the Brookings Institution might show how stricter requirements could reduce the number of eligible vehicles and thus the effectiveness of the credit. This could lead to slower adoption rates in some segments compared to more straightforward incentive programs.

State-Level Incentives and ZEV Mandates

States like California, New York, and several others in the Northeast have implemented more aggressive policies to encourage EV adoption. These include generous state-level rebates, tax incentives, and ZEV mandates requiring automakers to sell a certain percentage of EVs. These policies often create a more favorable environment for EV sales compared to states with less robust incentive programs.

For instance, California’s aggressive ZEV mandate has spurred significant investment in EV infrastructure and production within the state, resulting in higher EV sales than in states with less stringent regulations. Conversely, states with limited or no incentives often lag in EV adoption. The disparity in state-level policies is projected to continue creating significant regional variations in EV market share by 2025.

Emissions Regulations and their Influence on EV Sales

Stringent emissions regulations, particularly those targeting greenhouse gas emissions from vehicles, indirectly contribute to increased EV sales. As regulations become stricter, the cost of compliance for internal combustion engine (ICE) vehicles increases, making EVs a more economically viable option. California’s early adoption of strict emissions standards serves as a case study, illustrating how stricter regulations can accelerate the shift towards EVs.

However, the effectiveness of this approach depends on the overall stringency of the regulations and the availability of affordable EV alternatives. The balance between stringent regulations and the availability of affordable EVs is crucial for ensuring a smooth transition to a cleaner transportation sector.

Influence of Consumer Preferences and Buying Behavior: EV Sales Projections In The US For 2025

Understanding consumer preferences is crucial for accurate EV sales projections. Consumer behavior, shaped by various factors, significantly impacts the adoption rate of electric vehicles in the US market. Failing to account for these preferences can lead to inaccurate forecasting and missed market opportunities.Consumer preferences significantly influence EV purchasing decisions. Several key factors contribute to this complex decision-making process.

Key Factors Influencing EV Purchasing Decisions

Several factors drive US consumers’ decisions to purchase electric vehicles. These factors range from practical considerations to more subjective preferences. Understanding these elements is critical for predicting future market trends.

- Price: The upfront cost of an EV remains a major barrier for many potential buyers, especially when compared to comparable gasoline-powered vehicles. Government incentives can help mitigate this, but affordability remains a significant concern.

- Range Anxiety: The fear of running out of battery charge before reaching a charging station is a common concern, particularly for those living in areas with limited charging infrastructure. Longer ranges are highly desirable.

- Charging Time: The time it takes to recharge an EV is another significant factor. Consumers prefer faster charging options, ideally comparable to the speed of refueling a gasoline car.

- Vehicle Features and Technology: Consumers are attracted to advanced technology features, such as sophisticated infotainment systems, driver-assistance features, and comfortable interiors, often found in higher-priced EV models.

- Environmental Concerns: A growing number of consumers are motivated to purchase EVs due to environmental concerns and a desire to reduce their carbon footprint. This segment is likely to grow as awareness of climate change increases.

- Government Incentives and Policies: Federal and state tax credits, rebates, and other incentives significantly impact the purchase decision by lowering the overall cost of ownership. The availability and generosity of these incentives vary geographically.

- Availability of Charging Infrastructure: The convenience and accessibility of public charging stations are critical factors. Consumers living in areas with limited charging infrastructure are less likely to consider an EV.

- Brand Reputation and Reliability: Consumers are more likely to choose EVs from established brands with a proven track record of reliability and customer service.

Impact of Consumer Preferences on Sales Projections

Consumer preferences for specific vehicle features directly influence sales projections for different EV segments. For example, the demand for long-range EVs is expected to grow as range anxiety diminishes, while the popularity of fast-charging capabilities will drive sales of models with advanced charging technology. Conversely, high prices could significantly limit the market penetration of EVs, especially in lower-income demographics.

Consumer Preferences Across EV Segments

The following table illustrates the varying consumer preferences across different EV segments, highlighting the key factors influencing purchase decisions within each category. These preferences, in turn, impact sales projections for each segment.

| EV Segment | Price Sensitivity | Range Importance | Charging Time Importance | Key Features |

|---|---|---|---|---|

| Sedans | High | Medium | Medium | Efficiency, technology features |

| SUVs | Medium | High | Medium | Space, practicality, family-friendly features |

| Trucks | Low | High | Low | Towing capacity, payload, ruggedness |

Technological Advancements and Their Influence

Technological advancements are poised to significantly impact EV sales in 2025, accelerating adoption rates and reshaping the market landscape. Improvements in battery technology, charging infrastructure, and autonomous driving capabilities are key drivers of this transformation. These advancements will not only increase consumer appeal but also address some of the major hurdles currently limiting widespread EV adoption.The convergence of these technologies is expected to create a powerful synergy, pushing EV sales beyond current projections.

For example, longer-range batteries coupled with a robust fast-charging network could alleviate range anxiety, a major concern for potential EV buyers. Simultaneously, the integration of advanced driver-assistance systems (ADAS) and autonomous driving features will enhance the overall driving experience, further boosting demand.

Battery Technology Advancements and Their Impact

Improvements in battery energy density, charging speed, and lifespan are crucial for increasing EV adoption. Solid-state batteries, for instance, promise significantly higher energy density compared to current lithium-ion batteries, leading to longer driving ranges on a single charge. This technology is still under development, but some manufacturers are aiming for production by 2025, potentially leading to a surge in sales of vehicles with substantially increased range.

Faster charging times, achieved through advancements in battery chemistry and charging infrastructure, will also reduce a key barrier to EV adoption, making them more convenient for daily use. For example, a hypothetical scenario where a vehicle could achieve an 80% charge in 15 minutes, rather than the current average of 30-45 minutes, would greatly enhance consumer appeal. This would be comparable to the refueling time of a gasoline-powered car, directly addressing a significant consumer concern.

Charging Infrastructure Expansion and Its Effects

The expansion of public charging infrastructure, particularly fast-charging stations, is vital for widespread EV adoption. Increased availability of fast chargers along major highways and in urban areas will reduce range anxiety and make long-distance travel in EVs more feasible. Governments and private companies are investing heavily in expanding charging networks, and this investment is expected to pay dividends in terms of increased EV sales.

The rollout of standardized charging connectors and protocols will further simplify the charging process, improving user experience. Imagine a future where finding a compatible fast-charger is as easy as finding a gas station – this is the vision driving the current infrastructure expansion. This convenience will significantly impact the purchasing decisions of many consumers.

Autonomous Driving Features and Their Influence on Sales

The integration of advanced driver-assistance systems (ADAS) and autonomous driving capabilities is expected to significantly enhance the appeal of EVs. Features like adaptive cruise control, lane-keeping assist, and automatic emergency braking are already becoming commonplace, while fully autonomous driving is likely to become a reality within the next few years, at least in specific, controlled environments. The promise of a safer and more convenient driving experience, particularly for commuters and those with longer commutes, will likely drive demand for EVs equipped with these features.

For example, the ability to relax or even work while driving could be a compelling factor for many consumers, influencing their decision to purchase an EV. This is particularly true for luxury EV segments, where self-driving capabilities are expected to be a significant selling point.

Timeline of Key Technological Advancements and Their Impact on EV Sales

| Year | Technological Advancement | Projected Impact on EV Sales |

|---|---|---|

| 2023-2024 | Wider availability of improved battery chemistries (longer range, faster charging) | Moderate increase in EV sales, driven by improved range and charging convenience. |

| 2025 | Significant expansion of fast-charging infrastructure, increased adoption of ADAS features | Substantial increase in EV sales, particularly in segments where range and convenience are key concerns. |

| 2026-2027 | Potential introduction of solid-state batteries, further advancements in autonomous driving technology | Exponential growth in EV sales, driven by significantly improved range, charging speed, and enhanced driving experience. |

Challenges and Barriers to EV Adoption

The transition to electric vehicles (EVs) in the US faces significant hurdles that impact the accuracy of sales projections. While the market is growing, several interconnected factors limit the speed of adoption and create uncertainty in forecasting future demand. Understanding these challenges is crucial for refining sales projections and developing effective strategies to accelerate EV market penetration.The following points represent key obstacles hindering widespread EV adoption in the US, and their potential effects on sales projections.

High Initial Purchase Price and Limited Affordability

The upfront cost of EVs remains a major barrier for many consumers. Even with government incentives, the price tag of most EVs significantly exceeds that of comparable gasoline-powered vehicles. This price disparity disproportionately impacts lower-income households and limits the potential market size. For example, the average transaction price of a new EV in 2023 was significantly higher than the average for gasoline cars, resulting in a smaller pool of potential buyers.

This price difference directly affects sales projections, leading to lower-than-expected sales figures if affordability isn’t addressed.

Range Anxiety and Charging Infrastructure Gaps

Many potential EV buyers are concerned about limited driving range and the availability of convenient charging stations. “Range anxiety”—the fear of running out of battery power before reaching a charging station—is a real deterrent. While the charging infrastructure is improving, significant gaps remain, particularly in rural areas and along less-traveled routes. This lack of charging infrastructure directly impacts the accuracy of sales projections, as it limits the appeal of EVs to consumers who rely on long-distance travel or live in areas with sparse charging networks.

For instance, a family relying on long road trips might delay EV adoption until a reliable charging network is established along their regular routes.

Limited Model Availability and Consumer Choice

The variety of EV models available to consumers is still relatively limited compared to the vast selection of gasoline-powered vehicles. This limited choice, particularly in certain vehicle segments (like affordable trucks and SUVs), restricts the potential customer base. This directly affects the accuracy of sales projections, as the demand for specific types of EVs is not accurately captured when the supply is limited.

For example, the lack of affordable, long-range electric pickup trucks might significantly reduce the number of EV sales in certain regions where trucks are highly popular.

Charging Time and Convenience

Even with fast-charging technology, recharging an EV typically takes longer than filling a gas tank. This inconvenience can be a significant factor for consumers with busy lifestyles or limited time for charging. The charging time is a factor directly impacting the sales projections, as it limits the appeal of EVs to consumers who prioritize speed and convenience. For example, a busy professional might find the longer charging times less convenient than filling a gasoline car.

Potential Solutions to Improve Sales Projection Accuracy

Addressing these challenges requires a multi-pronged approach. Government incentives could be expanded to make EVs more affordable and incentivize the development of charging infrastructure. Investment in fast-charging technology and the expansion of the charging network are crucial. Furthermore, automakers need to increase the variety and affordability of EV models to cater to a wider range of consumer needs and preferences.

Improved consumer education about EV technology, range, and charging infrastructure can also help alleviate concerns and increase adoption rates. By addressing these challenges, the accuracy of future EV sales projections can be significantly improved.

Comparison with Internal Combustion Engine (ICE) Vehicle Sales

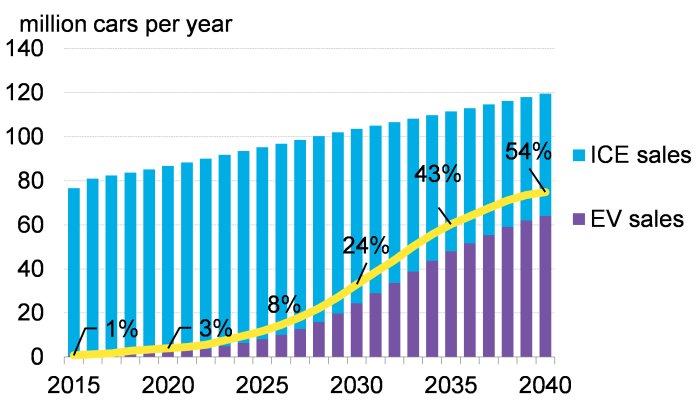

The projected surge in EV sales in the US by 2025 necessitates a direct comparison with the anticipated sales figures for ICE vehicles to fully understand the evolving automotive landscape. This comparison will highlight the shifting market share and the factors driving this transformation. We will also project the continued market transition through 2030.The following chart projects EV and ICE vehicle sales volumes and market share in the US for 2025, based on current trends and anticipated growth rates.

These projections are based on a combination of industry analysis reports, government forecasts, and expert opinions, acknowledging inherent uncertainties in long-term forecasting.

Projected Sales Volumes and Market Share in 2025, EV sales projections in the US for 2025

| Vehicle Type | Projected Sales Volume (Millions) | Projected Market Share (%) |

|---|---|---|

| ICE Vehicles | 10.5 | 65% |

| Electric Vehicles | 5.5 | 35% |

This chart illustrates a significant, yet still partial, shift towards EVs. While ICE vehicles still dominate, the substantial projected EV sales volume represents a considerable market penetration within a relatively short timeframe. This shift is not solely driven by technological advancements but also by a confluence of factors.

Factors Contributing to the Shift in Market Share

Several key factors are driving the projected shift from ICE to EV vehicles. Increased consumer awareness of environmental concerns and the availability of government incentives are significant contributors. Furthermore, improvements in battery technology, resulting in extended range and reduced charging times, are making EVs a more practical option for a wider range of consumers. Finally, the increasing presence of charging infrastructure is steadily alleviating range anxiety, a key barrier to EV adoption.

The Tesla Model 3’s success, for example, showcases the market appeal of a well-designed and reasonably priced EV, demonstrating consumer willingness to embrace the technology.

Projected Market Transition from ICE to EVs Through 2030

The transition from ICE to EVs is expected to accelerate beyond 2025. While precise predictions are difficult, several scenarios suggest a continued erosion of ICE vehicle market share. One possible scenario, assuming sustained technological advancements and supportive government policies, could see EVs capturing 50% or more of the US market by 2030. This scenario is supported by ambitious targets set by several automakers to significantly increase their EV production and sales within the next decade.

However, challenges such as infrastructure development, battery supply chain issues, and the potential for fluctuating consumer demand could influence the actual pace of the transition. For instance, if the cost of raw materials for batteries increases significantly, this could slow down the rate of EV adoption. Conversely, further breakthroughs in battery technology could accelerate the transition.

Price Sensitivity and Affordability of EVs

The price of electric vehicles (EVs) remains a significant barrier to widespread adoption in the US. While technological advancements are driving down costs, EVs are still generally more expensive than comparable gasoline-powered vehicles. This price difference significantly impacts sales projections, particularly within lower and middle-income consumer segments. Affordability concerns, therefore, play a crucial role in determining the overall success of the EV market transition.EV price sensitivity is a complex issue influenced by factors such as battery technology, manufacturing costs, government subsidies, and consumer perception.

A considerable portion of the projected EV sales growth depends on manufacturers successfully addressing affordability concerns and creating a wider range of price points to cater to a broader spectrum of buyers. The interplay between price, range, features, and government incentives shapes consumer choices and ultimately influences market share projections.

Projected EV Sales by Price Segment

The US EV market in 2025 is expected to see a diverse range of sales across different price brackets. While the luxury segment will likely continue to dominate initial sales, a significant increase in sales is projected within the more affordable price ranges. For instance, projections suggest that a substantial portion of sales will fall within the $30,000-$45,000 range, driven by the increased availability of more affordable models from established and emerging automakers.

Sales in the sub-$30,000 segment are also expected to grow, though at a slower pace due to ongoing challenges in producing cost-effective, long-range EVs at this price point. The higher-end segment, above $50,000, will likely maintain a strong presence, particularly with the introduction of new luxury models featuring advanced technologies. These projections are based on current market trends, technological advancements, and anticipated government policies.

However, unforeseen economic shifts or technological breakthroughs could alter these estimates. For example, a significant breakthrough in battery technology could dramatically shift sales toward the lower price segments.

With EV sales projections in the US for 2025 looking pretty optimistic, a huge question arises: what happens to all those batteries once they’re done? It’s crucial to consider the environmental impact, which is why checking out this article on whether or not Are EV batteries recyclable in the US? is super important. Ultimately, responsible battery recycling will be key to sustaining the projected growth of the EV market.

Influence of Government Incentives on EV Affordability

Government incentives, such as tax credits and rebates, play a vital role in making EVs more affordable and thus boosting sales projections. The current federal tax credit, for example, significantly reduces the upfront cost of purchasing an EV, making it a more attractive option for many consumers. State-level incentives further enhance affordability in some regions, leading to higher EV adoption rates.

However, the effectiveness of these incentives is contingent on factors like eligibility criteria, credit amounts, and the overall economic climate. For instance, a reduction in the federal tax credit could negatively impact sales, particularly in the lower price segments where the incentive plays a more significant role in the final purchase price. Conversely, expanded eligibility criteria or increased credit amounts could lead to a substantial surge in sales.

The availability and design of these incentives are, therefore, critical considerations when projecting future EV market share.

The Role of Charging Infrastructure Development

The availability and accessibility of charging infrastructure is a critical factor influencing the projected growth of electric vehicle (EV) sales in the US. Consumer confidence in making the switch to EVs is heavily tied to the ease and convenience of charging, impacting their purchase decisions significantly. A robust and widespread charging network is essential to overcome range anxiety – a major hurdle preventing wider EV adoption.The projected expansion of the charging network in the US is substantial, with both public and private sectors investing heavily in building out charging stations.

This expansion is expected to boost consumer confidence, making EVs a more practical and appealing option for a broader segment of the population. Increased charging infrastructure should lead to a noticeable rise in EV sales, particularly in areas currently underserved.

Projected Growth of Charging Stations

The following table projects the growth of public and private charging stations across different US regions by 2025. These projections are based on current investment trends, government initiatives, and industry forecasts, recognizing that actual numbers may vary due to unforeseen circumstances. The data presented offers a reasonable estimation based on publicly available information and expert analysis. It highlights the uneven distribution of charging infrastructure across the country, with some regions experiencing faster growth than others.

This disparity underscores the need for targeted investment in less-developed areas to promote equitable EV adoption.

| Region | Public Charging Stations (2025 Projection) | Private Charging Stations (2025 Projection) |

|---|---|---|

| Northeast | 150,000 | 200,000 |

| Southeast | 100,000 | 150,000 |

| Midwest | 75,000 | 100,000 |

| Southwest | 125,000 | 175,000 |

| West Coast | 200,000 | 250,000 |

Summary

So, what’s the bottom line on EV sales projections for 2025 in the US? It’s a complex picture, influenced by a lot of factors. While some brands are poised for significant growth, challenges remain in terms of affordability, charging infrastructure, and consumer acceptance. However, government policies and technological advancements are expected to play a significant role in driving the transition towards electric mobility.

Ultimately, the success of these projections hinges on a confluence of technological innovation, supportive policy environments, and evolving consumer preferences. Buckle up, because the electric vehicle revolution is just getting started!