Cybersecurity insurance for connected cars – Cybersecurity insurance for connected cars: It’s not just about protecting your fancy gadgets, it’s about safeguarding your personal data and preventing a total digital meltdown. Think of it like this: your car is now a super-connected computer on wheels, vulnerable to hackers who could steal your info, disable your brakes (okay, maybe not

-that* yet), or even hold your car hostage with ransomware.

This isn’t some far-off sci-fi scenario; these are real threats, and insurance is your best defense in this brave new world of digital driving.

This exploration dives deep into the risks and rewards of insuring your connected car against cyberattacks. We’ll cover everything from the types of data your car collects (and what happens if it gets leaked) to the different insurance policies available and how to file a claim if things go south. We’ll also peek into the future of connected car cybersecurity, including the impact of self-driving technology and the role of emerging technologies like AI and blockchain.

Buckle up, it’s going to be a wild ride.

Defining the Connected Car Landscape

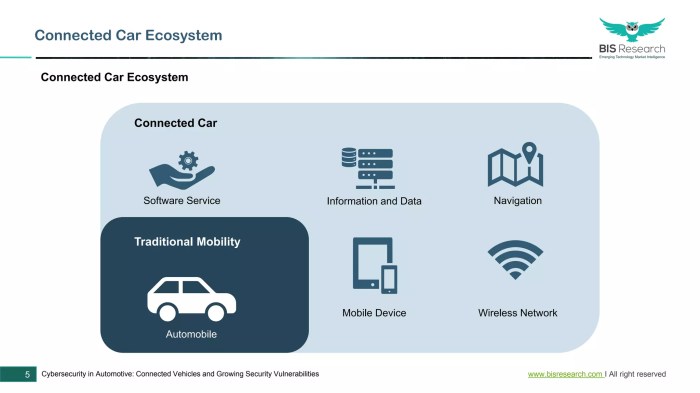

The connected car represents a significant convergence of automotive engineering and information technology, creating both exciting possibilities and substantial security risks. These vehicles are essentially mobile computing platforms, integrating various systems and communicating constantly with external networks. This interconnectedness, while offering convenience and enhanced features, dramatically expands the attack surface and necessitates a robust understanding of the associated vulnerabilities.The technological components of a connected car are numerous and interconnected, creating a complex ecosystem susceptible to attack.

These components range from basic onboard diagnostics (OBD) systems to sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and vehicle-to-everything (V2X) communication modules. Each component relies on software and hardware that can be exploited. For example, vulnerabilities in the infotainment system’s software could allow hackers to gain control of other vehicle functions, while weaknesses in V2X communication protocols could lead to traffic manipulation or even collisions.

Technological Components and Vulnerabilities

A connected car’s architecture is a complex network of interconnected systems, each with its own potential vulnerabilities. The infotainment system, often running on an operating system similar to a smartphone or tablet, is a frequent target. Its susceptibility to malware and phishing attacks can compromise user data and potentially even vehicle control systems. Similarly, the telematics control unit (TCU), responsible for communication with external networks, can be exploited to gain unauthorized access to vehicle data or even remotely manipulate vehicle functions.

Furthermore, ADAS components, which rely on sensor data and sophisticated algorithms, are vulnerable to spoofing attacks that could misrepresent sensor readings, leading to dangerous driving situations. Finally, the increasing use of over-the-air (OTA) updates introduces another avenue for attack, as compromised updates could install malicious code onto the vehicle’s systems.

The Evolving Threat Landscape for Connected Cars

The threat landscape for connected cars is constantly evolving, mirroring the advancements in technology and the ingenuity of malicious actors. Recent attacks have demonstrated the real-world consequences of vulnerabilities. In one instance, researchers demonstrated the ability to remotely unlock and start certain vehicle models through vulnerabilities in their mobile applications. Another example involved a successful attack that compromised a vehicle’s braking system through a manipulated CAN bus communication.

These examples highlight the potential for significant harm, ranging from theft and data breaches to physical harm and even fatalities. The increasing sophistication of attacks and the growing number of connected vehicles necessitate a proactive and comprehensive approach to cybersecurity.

Data Collected by Connected Cars and Potential Misuse

Connected cars collect a vast amount of data, including location information, driving habits, personal preferences, and even biometric data. This data can be extremely valuable to both legitimate businesses and malicious actors. Insurance companies may use driving data to assess risk and adjust premiums, while advertisers might target drivers with personalized ads based on their location and habits.

However, this data is also susceptible to misuse. Malicious actors could exploit data breaches to steal personal information, track individuals’ movements, or even use location data to target vehicles for theft or other crimes. The potential for identity theft, financial fraud, and physical harm underscores the critical need for robust data protection measures within the connected car ecosystem.

Cybersecurity Risks and Insurance Coverage

Connected cars, while offering incredible convenience and features, introduce a whole new level of cybersecurity risks. These risks aren’t just theoretical; they pose real threats to both drivers and the manufacturers who produce these vehicles. Understanding these risks and the insurance options available is crucial in mitigating potential damage and financial losses.The interconnected nature of modern vehicles means that a vast amount of data is constantly being transmitted and processed.

This creates numerous vulnerabilities that can be exploited by malicious actors. Cybersecurity insurance for connected cars aims to address these vulnerabilities and offer financial protection against the fallout.

Key Cybersecurity Risks for Connected Cars

Connected cars face a unique set of cybersecurity threats, ranging from relatively minor inconveniences to potentially life-threatening situations. These risks impact both individual drivers and the auto manufacturers responsible for the vehicles’ security.

- Data Breaches: Hackers could access sensitive personal information stored in the vehicle’s systems, such as location data, driving habits, and even personal contact information. This data could be used for identity theft, stalking, or other malicious purposes. The impact on drivers includes identity theft, financial loss, and emotional distress. Manufacturers face reputational damage and potential legal liabilities.

- Ransomware Attacks: Malicious software could lock down vehicle functions, demanding a ransom for their restoration. Imagine a scenario where a hacker disables a car’s braking system or locks the doors remotely, demanding payment to regain control. This poses a serious safety risk to drivers and creates significant liability for manufacturers.

- Vehicle Control Takeovers: In the most extreme cases, hackers could gain complete control of a vehicle’s critical systems, potentially causing accidents or even fatalities. This represents the ultimate cybersecurity nightmare for both drivers and manufacturers, leading to devastating consequences and extensive legal battles.

- Over-the-Air (OTA) Update Vulnerabilities: The process of updating vehicle software wirelessly, while convenient, also presents a potential attack vector. Compromised updates could introduce malware or vulnerabilities into the vehicle’s systems, impacting various functions and creating security loopholes.

Types of Cybersecurity Insurance Policies for Connected Cars

Several types of cybersecurity insurance policies are emerging to address the specific risks associated with connected cars. These policies differ in their coverage breadth and the types of incidents they protect against. Choosing the right policy depends on the specific needs and risk profile of the individual or manufacturer.

- First-Party Coverage: This type of coverage protects the vehicle owner or manufacturer against their own losses resulting from a cybersecurity incident. This could include costs associated with data recovery, system restoration, and legal fees.

- Third-Party Coverage: This coverage protects the insured against claims from third parties who have suffered losses as a result of a cybersecurity incident involving the connected car. For example, if a data breach exposes a driver’s personal information, leading to identity theft, this coverage would help cover the costs associated with the resulting claims.

- Recall Coverage: In the event of a widespread cybersecurity vulnerability requiring a vehicle recall, this coverage can help offset the substantial costs associated with notifying owners, repairing or replacing affected vehicles, and managing the public relations fallout.

Typical Coverage Offered by Cybersecurity Insurance for Connected Cars

Cybersecurity insurance policies for connected cars typically offer a range of coverage options designed to address the various risks Artikeld above. The specific coverage offered can vary significantly depending on the insurer and the policy purchased.

- Data Breach Response: This coverage helps cover the costs associated with investigating and responding to a data breach, including notification of affected individuals, credit monitoring services, and legal fees.

- Ransomware Payments: While some policies explicitly exclude ransom payments, others may offer coverage for a portion of the ransom amount under specific circumstances, especially if paying the ransom is deemed necessary to prevent more significant harm.

- Recall Expenses: As mentioned earlier, this coverage helps cover the substantial costs associated with recalling vehicles due to cybersecurity vulnerabilities. This can include engineering, manufacturing, logistics, and communications expenses.

- Legal and Regulatory Defense: This coverage helps cover the costs of legal representation and compliance with regulatory requirements following a cybersecurity incident. This is especially important given the increasing number of data privacy regulations worldwide.

- Business Interruption: For manufacturers, this coverage can help offset lost revenue resulting from a cybersecurity incident that disrupts operations.

Policy Considerations and Features

Securing cybersecurity insurance for your connected car involves understanding several key factors that influence both the cost and the extent of coverage. This section delves into those factors and provides a comparison of different insurance providers and a sample policy to illustrate the specifics.Factors influencing the cost of cybersecurity insurance for connected cars are multifaceted. Essentially, insurers assess risk based on a variety of elements.

Higher risk generally translates to higher premiums.

Factors Affecting Cybersecurity Insurance Premiums, Cybersecurity insurance for connected cars

Several factors significantly impact the cost of your connected car’s cybersecurity insurance. These include the vehicle’s type, the security measures already implemented, and the driver’s profile. Luxury vehicles, for example, often command higher premiums due to their increased value and the potentially greater sophistication of their connected systems, making them a more attractive target for cyberattacks. Conversely, vehicles with robust built-in security features, such as advanced encryption and regularly updated software, may qualify for lower premiums.

The driver’s history, specifically regarding claims or incidents involving technology, also plays a crucial role. A history of careless driving or technological incidents might lead to higher premiums.

Comparison of Cybersecurity Insurance Providers

The following table compares four hypothetical cybersecurity insurance providers, highlighting key features and coverage limits. Remember that these are examples and actual policies will vary. Always review the fine print!

| Provider | Coverage Limit (USD) | Key Features | Exclusions |

|---|---|---|---|

| CyberSafe Auto | $10,000 | Data breach recovery, ransomware protection, legal defense | Physical damage, loss of use |

| ConnectedCar Shield | $25,000 | Data breach recovery, ransomware protection, identity theft protection, software vulnerability remediation | Loss of personal data not related to a data breach, pre-existing conditions |

| DriveSecure Insurance | $50,000 | Comprehensive coverage including data breach, ransomware, legal defense, and vehicle replacement in case of total loss due to cyberattack | Acts of God, intentional damage |

| AutoCyberGuard | $100,000 | Highest coverage including data breach, ransomware, legal defense, vehicle replacement, and credit monitoring | Negligence, unauthorized modifications to vehicle software |

Sample Cybersecurity Insurance Policy for a Connected Car

This sample policy illustrates key clauses and exclusions. It is not a substitute for a legally binding contract.

This policy provides coverage for losses resulting from unauthorized access to, use of, or disclosure of data from your connected vehicle due to a cybersecurity incident. Coverage includes but is not limited to data breach recovery expenses, legal defense costs, and expenses related to mitigating the impact of the cyberattack.

Exclusions: This policy does not cover losses resulting from physical damage to the vehicle, loss of use of the vehicle not directly related to a cybersecurity incident, pre-existing conditions, or intentional acts by the policyholder.

The policy would also include specifics on the claims process, notification requirements, and the definition of a “cybersecurity incident.” It would also specify the policy term, premium amount, and any applicable deductibles. Specific details would vary based on the provider and the insured vehicle.

Claims Process and Dispute Resolution

Navigating a cybersecurity insurance claim for your connected car can feel overwhelming, but understanding the process and potential disputes can help you prepare. This section Artikels the typical claims process and provides insight into common disputes and their resolutions. Remember, specific procedures vary by insurer, so always refer to your policy documents.The claims process generally involves several key steps, from initial reporting to final settlement.

Effective communication and thorough documentation are crucial throughout this process. Failure to properly document events can lead to delays or claim denial.

Cybersecurity Incident Claim Reporting

Reporting a cybersecurity incident promptly is paramount. Most policies have specific timeframes for reporting, often within 24-72 hours of discovery. The initial report should include detailed information about the incident, such as the date and time, the type of attack (e.g., ransomware, data breach), the affected systems, and any immediate actions taken. Supporting documentation, such as diagnostic reports from your vehicle or security firm, should be gathered and submitted as soon as possible.

A detailed timeline of events, including communication with relevant parties (e.g., law enforcement, vehicle manufacturer), is highly beneficial.

Claim Investigation and Assessment

Following the initial report, the insurance company will launch an investigation to verify the claim. This might involve reviewing the provided documentation, contacting experts for technical analysis, and possibly conducting their own investigation. The insurer will assess the extent of the damage, considering factors such as the cost of repairs, data recovery, legal fees, and potential liability. This assessment can take time, and clear, concise communication with your insurer throughout this stage is crucial to avoid misunderstandings.

Cybersecurity insurance for connected cars is a growing concern, especially with the increasing sophistication of car hacking. Getting a new car, however, can be expensive, so if you’re looking to buy a new connected car, checking out resources like Best ways to finance a car with no money down might help. Once you’ve secured your ride, remember that comprehensive cybersecurity insurance is crucial to protect your investment and your personal data from potential threats.

Claim Settlement and Payment

Once the investigation is complete and the extent of the damage is determined, the insurer will make a settlement offer. This offer may cover all or a portion of the claimed expenses, depending on the policy coverage and the specifics of the incident. The settlement process may involve negotiations if the initial offer is unsatisfactory. A detailed explanation of the settlement, outlining the covered and excluded expenses, will typically be provided.

Payment is typically processed after the settlement is agreed upon.

Common Disputes and Resolutions

Disputes in cybersecurity insurance claims often arise from disagreements about the cause of the incident, the extent of the damages, or the policy coverage. For example, a dispute might arise if the insurer argues that the incident wasn’t covered under the policy due to a pre-existing vulnerability or a lack of reasonable security measures on the car owner’s part. Another common dispute is over the valuation of damages, particularly when dealing with intangible assets like data.

Resolving these disputes often involves detailed review of the policy terms, expert opinions, and potentially arbitration or litigation, as Artikeld in the policy’s dispute resolution clause. In cases involving significant financial loss or complex technical issues, seeking legal counsel is advisable. For instance, a dispute over the cost of data recovery could involve expert testimony from a data recovery specialist to support the claim.

Similarly, if the insurer disputes coverage due to a lack of security measures, the claimant might need to present evidence of their adherence to industry best practices.

Future Trends and Technological Advancements

The intersection of connected cars and cybersecurity is rapidly evolving, driven by both the increasing sophistication of vehicle technology and the ingenuity of cybercriminals. Predicting the future of cybersecurity insurance in this space requires considering the impact of emerging technologies and the ever-changing threat landscape. This section explores key trends shaping the future of this critical area of risk management.The rise of autonomous driving systems presents both exciting possibilities and significant cybersecurity challenges for the insurance industry.

The complex software and communication networks required for autonomous vehicles create numerous potential attack vectors, potentially leading to catastrophic accidents and substantial financial losses. This necessitates a re-evaluation of traditional insurance models, likely resulting in specialized policies with higher premiums and more granular risk assessments.

Autonomous Driving’s Impact on Cybersecurity Insurance

The shift towards autonomous vehicles will drastically alter the landscape of cybersecurity insurance. Currently, human error is a significant factor in car accidents. However, with autonomous vehicles, the source of accidents might shift to software vulnerabilities or malicious cyberattacks. Insurance companies will need to develop sophisticated risk models that account for the unique vulnerabilities of autonomous driving systems, including over-the-air (OTA) software updates, sensor manipulation, and potential for remote hijacking.

We can expect to see the emergence of specialized insurance products tailored to the specific risk profiles of different levels of autonomous driving capabilities (Levels 0-5). For example, a Level 5 fully autonomous vehicle would likely command a significantly different premium than a Level 2 partially autonomous vehicle. This granular approach will be crucial in accurately assessing and pricing risk.

Advancements in Cybersecurity Technology and Their Impact on Insurance

Advancements in cybersecurity technologies offer both opportunities and challenges for insurers. Artificial intelligence (AI) and machine learning (ML) can be instrumental in detecting and preventing cyberattacks in real-time, reducing the frequency and severity of incidents. This proactive approach could lead to lower insurance premiums for vehicles equipped with robust AI-powered security systems. Blockchain technology could improve transparency and accountability in the claims process, facilitating faster and more efficient dispute resolution.

For example, a tamper-proof record of vehicle data could help to verify the circumstances of an accident and determine liability more accurately. However, the very technologies intended to improve security can also introduce new vulnerabilities if not implemented and managed correctly. The increasing reliance on complex AI and blockchain systems necessitates a thorough understanding of their limitations and potential weaknesses.

Emerging Cybersecurity Threats to Connected Cars (Next Five Years)

The next five years will likely see a significant increase in the sophistication and frequency of cyberattacks targeting connected cars. This necessitates proactive measures by both automakers and insurers.The following are examples of emerging threats:

The increasing interconnectedness of vehicles within the broader Internet of Things (IoT) creates opportunities for attackers to exploit vulnerabilities across multiple devices. A successful attack on a seemingly unrelated device could potentially provide access to a vehicle’s system.

- Sophisticated AI-powered attacks: Malicious actors are increasingly leveraging AI to develop more effective and evasive attacks that can bypass traditional security measures. These attacks might involve adaptive malware that learns and adapts to a vehicle’s security systems.

- Exploitation of OTA update vulnerabilities: Over-the-air (OTA) software updates are essential for maintaining the security of connected cars, but they can also be a point of vulnerability. Attackers could exploit flaws in the update process to install malicious software or gain unauthorized access to the vehicle.

- Increased targeting of vehicle sensors: Compromising a vehicle’s sensors, such as cameras, radar, and lidar, could lead to accidents or enable malicious actors to manipulate the vehicle’s behavior. This could manifest as false readings leading to erratic driving or complete control of the vehicle’s movement.

- Data breaches targeting personal information: Connected cars collect vast amounts of personal data, making them attractive targets for data breaches. Stolen data could be used for identity theft or other malicious purposes.

- Advanced persistent threats (APTs): State-sponsored or highly organized criminal groups could launch sophisticated, long-term attacks to steal sensitive data or disrupt critical infrastructure.

Consumer Awareness and Education

Understanding cybersecurity risks associated with connected cars is crucial for both drivers and manufacturers. Many consumers are unaware of the vulnerabilities their vehicles possess and the potential consequences of a cyberattack. This lack of awareness highlights the need for increased consumer education and proactive measures by manufacturers to improve overall vehicle security.

Educating consumers about cybersecurity insurance for connected cars requires a multi-pronged approach. A clear and concise brochure can effectively communicate the importance of this type of insurance, while manufacturers can play a vital role in highlighting risks and available protections.

Cybersecurity insurance for connected cars is a growing concern, especially with the increasing sophistication of car hacking. Before you even think about insurance, though, you should check out the Pros and cons of leasing vs buying 2025 because the financial implications of a major cyberattack could significantly impact your ownership decision. Ultimately, the cost of dealing with a breach, even with insurance, could be huge, regardless of whether you lease or buy.

Cybersecurity Insurance for Connected Cars: A Consumer Brochure

This brochure aims to explain the benefits of cybersecurity insurance for your connected car. In today’s increasingly digital world, your vehicle is more vulnerable than ever before to cyber threats. Protecting your investment and personal information requires proactive measures, and cybersecurity insurance is a key component of that protection.

Protecting your connected car is more than just regular maintenance; it’s about safeguarding your data and your vehicle’s functionality from cyberattacks.

What are the risks? Connected cars, with their advanced technology and internet connectivity, are susceptible to hacking, data breaches, and even remote control manipulation. This can lead to theft, personal data compromise, and even safety hazards. Consider the potential for hackers remotely disabling critical safety features or accessing your personal information stored within the vehicle’s systems.

Cybersecurity insurance can provide financial protection against the costs associated with data breaches, system repairs, and even vehicle replacement in the event of a successful cyberattack.

What does the insurance cover? Policies typically cover expenses related to data recovery, software repairs, legal fees, and even potential financial losses due to data breaches. Specific coverage varies depending on the policy, so it’s essential to review the details carefully.

Don’t wait for a cyberattack to happen. Protect yourself and your investment with cybersecurity insurance for your connected car.

Recommendations for Improving Connected Car Cybersecurity

Taking proactive steps to enhance the cybersecurity of your connected car is essential. By following these recommendations, you can significantly reduce your risk of becoming a victim of a cyberattack.

- Keep your vehicle’s software updated: Manufacturers regularly release software updates that address known vulnerabilities. Ensure you install these updates promptly.

- Use strong and unique passwords: Avoid using easily guessable passwords for your in-car systems. Use complex passwords or consider using a password manager.

- Be cautious about connecting to public Wi-Fi networks: Public Wi-Fi networks are often less secure than your home network. Avoid connecting your car to public Wi-Fi whenever possible.

- Regularly review your connected car’s privacy settings: Familiarize yourself with your vehicle’s privacy settings and adjust them to minimize data collection.

- Install reputable antivirus and security software: If your vehicle allows, install and maintain reputable security software to help detect and prevent malicious activities.

- Be aware of phishing scams: Be wary of suspicious emails, texts, or calls that request personal information or login credentials related to your connected car.

Manufacturer Contributions to Consumer Awareness

Auto manufacturers play a crucial role in educating consumers about cybersecurity risks and insurance options. Their actions directly influence consumer understanding and adoption of protective measures.

- Clear and accessible information: Manufacturers should provide easily understandable information about the cybersecurity features of their vehicles and the potential risks associated with connected car technology.

- Proactive communication: Regularly communicate with consumers about software updates and security advisories. Use multiple channels such as email, in-car notifications, and mobile apps.

- Partnerships with cybersecurity insurance providers: Collaborate with insurance companies to offer bundled cybersecurity insurance packages or integrate information about available coverage directly into the vehicle’s infotainment system.

- Educational campaigns: Launch public awareness campaigns to educate consumers about the importance of cybersecurity for connected cars and how to mitigate risks.

- Transparent security practices: Be transparent about their vehicle’s security architecture and the measures they take to protect consumer data.

Regulatory Landscape and Legal Implications: Cybersecurity Insurance For Connected Cars

The intersection of connected cars, cybersecurity, and insurance is a rapidly evolving legal and regulatory landscape. Existing laws and regulations, designed for a less interconnected world, are struggling to keep pace with the unique risks posed by vehicles constantly communicating data. This necessitates a comprehensive understanding of the legal implications of cybersecurity incidents and how governments are shaping the future of insurance in this sector.The legal implications of data breaches and other cybersecurity incidents involving connected cars are significant and multifaceted.

Companies face potential liability for data breaches under various laws, including those concerning consumer privacy, data protection, and product liability. Furthermore, the potential for physical harm resulting from a compromised vehicle significantly raises the stakes, leading to potential lawsuits for negligence or even criminal charges in extreme cases.

Relevant Regulations and Laws

Several key regulations and laws are shaping the cybersecurity insurance landscape for connected cars. For example, the California Consumer Privacy Act (CCPA) and similar state laws mandate robust data security practices and impose penalties for failures to protect consumer data. The General Data Protection Regulation (GDPR) in Europe has a similar impact, extending its reach to companies processing data from EU residents, regardless of their location.

Federal regulations, such as those from the National Highway Traffic Safety Administration (NHTSA), are also increasingly focused on vehicle cybersecurity, setting standards and potentially influencing insurance requirements. These regulations impact insurance companies by influencing the risk assessment process, the types of coverage offered, and the premiums charged. Failure to comply with these regulations can lead to significant financial penalties for both automakers and insurers.

Legal Implications of Data Breaches

Data breaches in connected cars can expose sensitive personal information, such as driver location, driving habits, and even biometric data. This can lead to identity theft, financial losses, and even physical harm if the breach compromises vehicle control systems. Legal actions stemming from such breaches could include class-action lawsuits alleging negligence, breach of contract, or violations of data protection laws.

The potential for significant financial liabilities makes cybersecurity insurance a crucial risk mitigation strategy for automakers and connected car service providers. The costs associated with legal defense, settlements, and regulatory fines can quickly escalate, making insurance a necessary financial buffer.

Government Regulation Shaping Cybersecurity Insurance

Government regulations are playing a pivotal role in shaping the future of cybersecurity insurance for connected cars. Mandatory cybersecurity standards for vehicles, similar to those already in place for other critical infrastructure, could significantly impact the insurance market. Such regulations could mandate specific cybersecurity features in vehicles, leading to a lower risk profile and potentially lower insurance premiums for vehicles meeting these standards.

Conversely, vehicles failing to meet these standards could face higher premiums or even difficulty obtaining insurance. Furthermore, governments may establish specific insurance requirements for connected car services, such as mandatory cyber liability coverage for data breaches or system failures. This regulatory push towards greater accountability is expected to drive innovation in both vehicle cybersecurity and insurance products designed to address these emerging risks.

For example, the increasing focus on autonomous vehicles will undoubtedly lead to stricter regulations and a corresponding rise in the demand for specialized cybersecurity insurance policies.

Wrap-Up

So, is cybersecurity insurance for your connected car worth it? Absolutely. In a world where our cars are increasingly reliant on software and internet connectivity, the risk of cyberattacks is real and potentially devastating. Understanding the threats, securing appropriate insurance, and staying informed about evolving technologies are crucial steps in protecting yourself and your investment. Don’t wait until it’s too late; protect your ride and your peace of mind with the right cybersecurity insurance.