Best ways to finance a car with no money down? Yeah, it’s totally doable, but it’s not always a walk in the park. This guide breaks down all the options – loans vs. leases, finding lenders who’ll work with you, and even how to boost your credit score to snag better rates. We’ll cover everything from navigating dealership negotiations to understanding the fine print so you don’t get totally ripped off.

Basically, we’re here to help you score that sweet ride without emptying your bank account.

We’ll explore different financing methods, from traditional bank loans and credit unions to online lenders and even the possibility of a co-signer. We’ll also dive into the importance of budgeting and understanding the total cost of car ownership, including insurance, maintenance, and gas. Think of this as your ultimate survival guide to buying a car with zero down – because let’s be real, that first car is a HUGE deal.

Understanding Financing Options: Best Ways To Finance A Car With No Money Down

So, you’re ready to buy a car, but the thought of a hefty down payment is giving you pause. Don’t worry, plenty of options exist for financing a car even without a big upfront chunk of change. Let’s break down the two main ways to do this: loans and leases. Understanding the differences is key to making the best choice for your situation.

Loans versus Leases

Loans and leases are fundamentally different approaches to car financing. A loan is essentially a loan to buy the vehicle outright. You’re borrowing money to purchase the car, and once you’ve paid off the loan, the car is yours. A lease, on the other hand, is essentially renting the car for a set period. You make monthly payments, but you don’t own the car at the end of the lease term.

There are significant advantages and disadvantages to each, which we’ll explore.

Loan Advantages and Disadvantages

Loans offer the advantage of ownership. After paying off the loan, you own the car free and clear. You can drive it as much as you want, modify it, and even sell it whenever you choose. However, loans typically involve higher monthly payments than leases, especially if you finance the entire purchase price. Also, the car depreciates in value over time, meaning you may end up owing more than the car is worth (being “underwater”).

Repair costs are also your responsibility.

Lease Advantages and Disadvantages

Leasing often results in lower monthly payments than loans, because you’re only paying for the car’s depreciation during the lease term, not its full purchase price. Leases also often come with lower upfront costs, potentially making them more attractive if you’re short on cash. However, you don’t own the car at the end of the lease, and you’ll likely face restrictions on mileage and modifications.

You’re also responsible for excess wear and tear beyond normal use. Plus, you’ll need to start the whole process again when your lease is up.

Comparison of Financing Options

The best option for you depends on your individual circumstances and priorities. Here’s a table comparing typical loan and lease terms to illustrate the differences:

| Loan Type | APR | Typical Loan Term (Years) | Down Payment Requirements |

|---|---|---|---|

| New Car Loan | 4-7% | 3-7 | 0-20% |

| Used Car Loan | 6-10% | 3-5 | 0-10% |

| Lease (Typical) | N/A (money factor used) | 2-3 | Usually minimal or none |

Note: APR (Annual Percentage Rate) reflects the cost of borrowing. The money factor is used in leasing and is a similar concept to APR, but it is calculated differently. These figures are estimates and actual rates will vary based on credit score, lender, and vehicle type. Always shop around for the best rates.

Securing a Loan with No Down Payment

Snagging a car loan with zero down can feel like winning the lottery, but it’s definitely doable. It’s a bit trickier than putting some cash down, but with the right approach and understanding of the risks involved, you can drive off the lot without emptying your wallet upfront. This section dives into the nitty-gritty of securing this type of loan.Eligibility requirements for zero-down payment car loans are stricter than loans with a down payment.

Lenders want to minimize their risk, so they’ll scrutinize your creditworthiness more intensely. Think of it like this: They’re taking on more risk by lending you the entire car’s value, so your financial history needs to scream “reliable.”

Eligibility Requirements for Zero-Down Payment Car Loans

To qualify, you’ll typically need excellent credit (think a score of 700 or higher), a stable income that comfortably covers the monthly payments, and a clean driving record. Lenders will also pull your credit report to assess your debt-to-income ratio (DTI). A lower DTI – meaning you have less debt relative to your income – is always better. They might also look at your employment history; a long and consistent work history is a huge plus.

Finally, the type of car you’re buying might play a role. A used car might be easier to finance with no money down compared to a brand-new luxury vehicle.

So you’re trying to figure out the best ways to finance a car with no money down? One thing to keep in mind, especially if you’re leasing, is potential extra costs. Before you sign anything, check out this article on Lease mileage overage fees explained to avoid nasty surprises. Understanding these fees is crucial when comparing financing options and making sure you’re getting the best deal for your no-money-down car purchase.

Lenders Offering Zero-Down Payment Car Loans

Several lenders offer zero-down payment car loans, but they’re not always easy to find. Credit unions are often more willing to work with borrowers who have less-than-perfect credit than traditional banks. Some dealerships may also offer financing options with no down payment, but it’s crucial to compare interest rates and terms carefully, as they might be less competitive.

Online lenders are also an option, but thoroughly investigate their reputation and fees before committing.

Risks and Benefits of Financing a Car with No Down Payment

The biggest benefit, obviously, is not having to come up with a down payment. This can be a lifesaver for those with limited savings. However, the drawbacks can be significant. The most obvious is the higher total cost of the loan. Without a down payment, you’ll be financing the entire purchase price, leading to larger monthly payments and a higher total interest paid over the loan’s life.

You also increase your risk of being “underwater” on your loan – owing more than the car is worth – which can create financial headaches if you need to sell it.

Common Stipulations and Conditions Associated with Zero-Down Payment Loans

Zero-down loans often come with stricter terms and conditions. For instance, you might be required to purchase a more comprehensive insurance policy, including collision and comprehensive coverage. The interest rate is typically higher than loans with a down payment, reflecting the increased risk for the lender. The loan term might also be shorter, leading to higher monthly payments.

Finally, lenders may require you to have a co-signer with good credit to reduce their risk. For example, a 2018 study by Experian found that consumers with zero down payments had a higher average interest rate than those with a down payment. The exact figures vary based on several factors including credit score, lender, and vehicle type.

Improving Your Credit Score for Better Rates

Landing a sweet car loan without a down payment is totally doable, but your credit score plays a HUGE role in getting the best interest rates. Think of it like this: a good credit score is your golden ticket to lower monthly payments and saving serious cash in the long run. A bad score? Well, let’s just say you’ll be paying a lot more for that ride.A higher credit score means lenders see you as less risky, so they’re more willing to offer you better terms.

This translates to lower interest rates, which directly impacts your monthly payments and the total amount you pay over the life of the loan. Basically, a good credit score is your best friend when it comes to car financing.

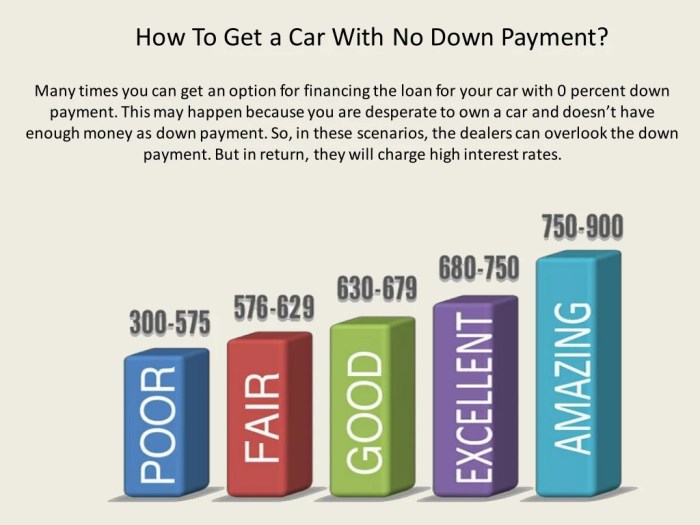

Understanding Credit Score Impact

Your credit score is a three-digit number (ranging from 300 to 850) that summarizes your creditworthiness. Lenders use this number to assess the risk of lending you money. A higher score indicates a lower risk, resulting in more favorable loan terms, including lower interest rates. Conversely, a lower score suggests higher risk, leading to higher interest rates and potentially stricter lending requirements.

Even a small difference in your score can significantly impact the cost of your car loan.

Improving Your Credit Score: A Step-by-Step Guide

Improving your credit score takes time and consistent effort, but it’s definitely achievable. Here’s a breakdown of how to boost those numbers:

- Check Your Credit Report: First things first, get your free credit reports from AnnualCreditReport.com. Review them carefully for any errors. Disputes any inaccuracies immediately.

- Pay Bills on Time: This is the single most important factor affecting your credit score. Set up automatic payments or reminders to avoid late payments. Even one late payment can significantly hurt your score.

- Keep Credit Utilization Low: Your credit utilization ratio is the percentage of your available credit that you’re using. Aim to keep this below 30%, ideally closer to 10%. Paying down your balances can dramatically improve your score.

- Maintain a Mix of Credit: Having a variety of credit accounts (credit cards, installment loans) can positively impact your score, but don’t open new accounts just for the sake of it.

- Don’t Apply for Too Much Credit: Each credit application results in a hard inquiry on your credit report, which can temporarily lower your score. Avoid applying for multiple loans or credit cards within a short period.

- Keep Older Accounts Open: The length of your credit history is a significant factor. Keeping older accounts open (even if you don’t use them much) demonstrates a long-term responsible credit history.

Credit Score Improvement Checklist

Before you start working on your credit, it’s helpful to create a personalized checklist. This way you can track your progress and stay organized.

- Obtain a copy of your credit report.

- Identify and dispute any errors.

- Create a budget and stick to it.

- Set up automatic payments for all bills.

- Pay down high-balance credit cards.

- Monitor your credit utilization ratio regularly.

- Avoid opening new credit accounts unless absolutely necessary.

Impact of Credit Score on Interest Rates

The following table illustrates how your credit score can significantly influence the interest rate you receive on a car loan. This is a simplified example, and actual rates may vary depending on the lender, loan term, and other factors.

| Credit Score Range | Interest Rate Range | Loan Amount (Example: $20,000) | Monthly Payment Difference (60-month loan) |

|---|---|---|---|

| 660-679 | 8%-10% | $20,000 | $390 – $410 (approximately) |

| 700-759 | 6%-8% | $20,000 | $360 – $390 (approximately) |

| 760-850 | 4%-6% | $20,000 | $330 – $360 (approximately) |

Negotiating with Dealerships

Buying a car without a down payment puts you in a slightly more vulnerable position during negotiations, but it’s definitely not impossible to get a good deal. Remember, dealerships are businesses, and their goal is to make a profit, but that doesn’t mean you can’t advocate for yourself and get the best possible terms. Being prepared and knowing your options are key.Dealerships are generally more flexible than you might think, particularly if they’re trying to move inventory or if you’re showing a willingness to work with them, even without a large down payment.

The key is to be informed, confident, and polite – a winning combination in any negotiation.

Interest Rate Negotiation Strategies

Successfully negotiating an interest rate hinges on your credit score and the loan terms you’re willing to accept. A higher credit score gives you significantly more leverage. Before you even step foot in a dealership, get pre-approved for a loan from a bank or credit union. This gives you a concrete number to work with and prevents you from being pressured into accepting a higher rate from the dealership’s financing arm.

Armed with a pre-approved rate, you can confidently present it as your baseline, showing the dealer that you’re a serious buyer with options. If the dealership offers a better rate, great! But having your own financing secured protects you from being overcharged. For example, if your pre-approved rate is 6%, you can use that as your benchmark, and if the dealership only offers 7%, you have a clear basis for further negotiation or walking away.

Communicating Your Financial Situation

Honesty is the best policy, but that doesn’t mean you need to spill your entire financial life story. Clearly and concisely state that you’re looking to purchase a vehicle without a down payment due to [your reason, e.g., saving for a down payment on a house, recent unexpected expenses]. Focus on your positive attributes: a stable job, consistent income, and a plan to repay the loan.

Prepare a concise summary of your financial situation, highlighting your strengths, to present to the dealer. This might include your employment history, income verification, and credit score information. Avoid dwelling on the negatives; instead, emphasize your commitment to responsible repayment. For example, you might say, “While I’m not putting money down today, my stable employment and strong payment history make me a reliable borrower.”

Avoiding Negotiation Pitfalls

One common mistake is getting emotionally attached to a specific vehicle before negotiating the terms. Falling in love with a car before securing financing can cloud your judgment and make you more susceptible to accepting unfavorable terms. Another pitfall is not understanding the total cost of ownership. Focus on the monthly payment and the total interest paid over the loan’s lifetime, not just the sticker price.

Be wary of add-ons like extended warranties or paint protection packages; these can significantly increase the overall cost of the vehicle. Also, avoid getting pressured into making a quick decision. Dealerships often use high-pressure tactics, so take your time, carefully review all documents, and don’t be afraid to walk away if the deal isn’t right for you.

Examples of Strong Negotiating Positions and Phrases

A strong negotiating position starts with thorough research and a clear understanding of your financial capabilities. Having a pre-approved loan is crucial. Remember phrases like: “I’ve been pre-approved for a loan at 6% interest; can you match or beat that?” or “My budget allows for a maximum monthly payment of $X; can we structure the loan to fit that?” Or, if you are confident in your credit and want to try for a better rate: “Given my credit score and consistent payment history, I believe a lower interest rate is achievable.” Remember, confidence, politeness, and preparedness are your best allies.

Avoid phrases like “I’ll take it if you lower the price” without a reasonable offer. Instead, make a specific, well-researched counteroffer.

Exploring Alternative Financing Methods

So, you’re looking to buy a car with zero down payment, and traditional loans seem a bit out of reach? Don’t worry, there are alternative routes you can explore to make your car-buying dreams a reality. This section dives into some less conventional financing methods that might be the perfect fit for your situation. We’ll examine the pros and cons of each, helping you make an informed decision.

So, you’re looking at ways to finance a car with zero down? That’s totally doable, but remember insurance is a huge part of the equation. Once you’ve got your loan sorted, check out the Top-rated car insurance companies for seniors 2025 to find the best rates for your budget. Getting the right insurance will help keep your monthly costs manageable, even with that no-money-down car loan.

Finding a car loan without a down payment can be challenging, but it’s not impossible. Alternative financing options offer a chance to bypass the typical hurdles of securing a loan. Understanding these options is key to finding the best fit for your financial situation.

Using a Co-Signer to Secure a Loan

A co-signer essentially acts as a guarantor on your loan. They agree to be responsible for the payments if you default. Lenders are more willing to approve loans with co-signers because it reduces their risk. However, it’s crucial to remember that a co-signer is taking on significant financial responsibility. Choose your co-signer carefully, ideally someone with excellent credit and a stable income who understands the commitment involved.

Be sure to have an open and honest conversation with your potential co-signer about the terms of the loan and their responsibilities.

Obtaining Financing Through a Credit Union

Credit unions are member-owned financial institutions that often offer more favorable loan terms than traditional banks. Because they prioritize member satisfaction, they may be more willing to work with borrowers who have less-than-perfect credit or need a loan with no down payment. The application process might be slightly different, often involving a more personal touch than a large bank.

It’s worth exploring your local credit union options, especially if you have a history of responsible financial management.

Potential Benefits and Drawbacks of Using Alternative Lenders, Best ways to finance a car with no money down

Alternative lenders, including online lenders and some smaller finance companies, often cater to borrowers with less-than-stellar credit scores. They might offer more flexible loan options, but this flexibility often comes at a higher cost, such as higher interest rates and fees. While they can provide a lifeline for those struggling to secure a loan through traditional channels, it’s vital to thoroughly research the lender and compare their terms to avoid getting trapped in a high-interest debt cycle.

Carefully read the fine print and understand all associated fees before committing.

Comparing Financing Sources: Banks, Credit Unions, and Online Lenders

Choosing the right financing source is crucial. Each option presents a unique set of advantages and disadvantages in terms of interest rates and loan requirements. Let’s break down the key differences:

- Banks: Typically offer competitive interest rates for borrowers with good credit. Loan requirements are usually stringent, often requiring a significant down payment and a high credit score. They may be less flexible with borrowers who have a less-than-perfect credit history.

- Credit Unions: Often provide more favorable interest rates and loan terms, particularly for members. They may be more willing to work with borrowers who have less-than-perfect credit or need a loan with no down payment. However, membership requirements might apply.

- Online Lenders: Offer convenience and a potentially faster application process. Interest rates can vary widely depending on the borrower’s creditworthiness and the lender’s policies. Some online lenders specialize in loans for borrowers with poor credit, but these often come with higher interest rates and fees.

Budgeting and Affordability

Buying a car, even without a down payment, is a significant financial commitment. Before you even think about signing on the dotted line, you absolutely need a solid understanding of your budget and whether you can realistically afford the total cost of car ownership. Failing to do so can lead to serious financial problems.Creating a realistic budget that incorporates car payments involves a thorough assessment of your income and expenses.

This isn’t just about the monthly payment; it encompasses all costs associated with owning a vehicle.

Calculating Total Cost of Car Ownership

Accurately determining the total cost of car ownership goes beyond the monthly loan payment. You must consider all associated expenses to create a truly comprehensive budget. Failing to account for these hidden costs can lead to unexpected financial strain and potential default on your loan.

- Monthly Loan Payment: This is the most obvious cost, but remember to include interest and any additional fees.

- Insurance: Car insurance premiums vary widely based on your age, driving record, location, and the type of vehicle. Obtain quotes from several insurers to compare rates.

- Fuel: Gas prices fluctuate, so factor in an average monthly cost based on your estimated mileage and fuel efficiency of the vehicle. Consider using a fuel cost calculator that takes into account your vehicle’s MPG and your average driving distance. For example, if you drive 1,000 miles a month and your car gets 25 mpg, and gas costs $3.50/gallon, your monthly fuel cost would be approximately $140.

- Maintenance and Repairs: Set aside a monthly amount for routine maintenance (oil changes, tire rotations) and unexpected repairs. A good rule of thumb is to budget at least $100-$200 per month, depending on the age and condition of the vehicle.

- Parking and Tolls: If you live in a city or frequently use toll roads, factor in these expenses.

- Taxes and Fees: Some states have annual vehicle registration fees or property taxes on vehicles.

Consequences of Unaffordable Car Payments

Failing to budget properly for car payments can have severe repercussions. These consequences can significantly impact your financial well-being and credit score.

- Late Payments and Fees: Missed or late payments result in late fees and negatively impact your credit score, making it harder to obtain loans in the future.

- Repossession: If you consistently fail to make payments, the lender can repossess your vehicle, leaving you without transportation and a damaged credit history.

- Debt Cycle: Falling behind on car payments can lead to a cycle of debt, making it difficult to manage other financial obligations.

- Financial Stress: The constant worry and stress associated with struggling to make car payments can negatively affect your overall well-being.

Sample Budget Template

A well-structured budget is crucial for managing your finances and ensuring you can afford a car. The following is a sample budget template; adjust it to reflect your own income and expenses.

- Income: List your monthly net income (after taxes).

- Essential Expenses:

- Rent/Mortgage

- Utilities (electricity, water, gas)

- Groceries

- Student Loans/Other Debt Payments

- Car Expenses:

- Car Loan Payment

- Car Insurance

- Fuel

- Maintenance/Repairs

- Other Expenses:

- Entertainment

- Dining Out

- Subscriptions

- Savings

- Total Expenses: Sum of all expenses.

- Remaining Funds: Income minus total expenses. This should ideally be a positive number, representing your savings or disposable income.

Remember: The 20/4/10 rule suggests that your monthly car payment should not exceed 20% of your monthly net income, your car insurance should not exceed 4%, and your total car expenses (including fuel, maintenance) should not exceed 10% of your net income. This is a guideline, and your specific situation may vary.

Understanding the Fine Print

Before you sign on the dotted line for your new car loan, it’s crucial to understand every detail of the contract. Ignoring the fine print can lead to unexpected costs and financial headaches down the road. This section will help you navigate the complexities of car loan agreements and avoid common pitfalls.

Car loan agreements are legally binding contracts, and failing to understand their terms can have significant financial consequences. Many borrowers are overwhelmed by the dense legal jargon and rush through the process without fully grasping the implications. Taking the time to carefully review the document is essential to protect your financial interests. This includes understanding interest rates, fees, and repayment schedules, as well as identifying potential hidden costs or deceptive practices.

Common Terms and Conditions in Car Loan Agreements

Car loan agreements typically include details about the loan amount, interest rate (often expressed as an Annual Percentage Rate or APR), loan term (the length of the loan), and monthly payment amount. They also specify the repayment schedule, including due dates and methods of payment. Crucially, the agreement will Artikel any penalties for late or missed payments, such as late fees or potential repossession of the vehicle.

The contract should clearly state whether the loan is secured (meaning the car serves as collateral) or unsecured. Finally, prepayment penalties (fees for paying off the loan early) should be clearly defined.

Potential Hidden Fees and Charges

Beyond the obvious costs, several hidden fees can significantly increase the overall cost of your car loan. These charges are often buried in the fine print and can easily be overlooked. Be on the lookout for fees associated with document preparation, origination fees (fees charged by the lender for processing the loan), and potentially excessive dealer fees. Some lenders also charge prepayment penalties, which can make it more expensive to pay off your loan early.

Carefully compare loan offers from different lenders to identify any unusually high fees.

Examples of Deceptive Lending Practices

Unfortunately, some lenders engage in deceptive practices to lure borrowers into unfavorable loan terms. One common tactic is to advertise low interest rates without disclosing additional fees that significantly increase the overall cost. Another is to use confusing language or complex calculations to obscure the true cost of the loan. “Balloon payments,” where a large final payment is due at the end of the loan term, can also be deceptive, as they may not be clearly explained upfront.

Always compare the APR across different offers to get a clear picture of the true cost of borrowing.

Glossary of Important Car Loan Terms

Understanding the language used in car loan agreements is vital. Here’s a glossary of common terms:

- APR (Annual Percentage Rate): The annual interest rate charged on the loan, including fees.

- Loan Term: The length of time you have to repay the loan (e.g., 36 months, 60 months).

- Monthly Payment: The fixed amount you pay each month to repay the loan.

- Principal: The original amount of the loan.

- Interest: The cost of borrowing money.

- Origination Fee: A fee charged by the lender for processing the loan.

- Prepayment Penalty: A fee charged for paying off the loan early.

- Collateral: The asset (in this case, the car) used to secure the loan.

- Balloon Payment: A large final payment due at the end of the loan term.

Ultimate Conclusion

So, buying a car with no money down? Definitely possible, but it requires some serious planning and savvy negotiation. By understanding the different financing options, improving your credit, and knowing how to work with dealerships, you can significantly increase your chances of getting approved and securing a manageable loan. Remember to always read the fine print, create a realistic budget, and don’t be afraid to shop around for the best rates.

Now go get that car!